[ad_1]

The exchange rate of the GBP/USD fell further last week but with the dollar now facing technical resistance against the euro and the Swiss franc, the US dollar index may be in danger of running out of momentum. This in turn may help the GBP/USD to stabilize close to current levels in the near future. The currency pair’s losses reached the 1.1760 support level, its lowest since the markets collapsed in March 2020 due to fears of a global epidemic, and closed the week’s trading stable around the level of 1.1863.

Overall, the British Pound saw only temporary relief from the recent sell-off against the dollar and mostly in the wake of the slightly better-than-expected UK GDP report when it revealed economic growth of 0.5% for the month of May. It followed observations from a series of BoE rate-setters, including Deputy Governor David Ramsden, Governor Andrew Bailey and chief economist Howe Bell, each of which suggested the increases could continue, if not bigger or faster. in raising the bank rate.

“The new week comes with the release of UK CPI, Jobs and PMIs which will shape the outlook ahead of the BoE’s policy decision in August as it looks highly likely that the bank will raise interest rates by as much as 50 bps – The data could increase speculation about a 75 bps hike. However, we believe the country’s cost-of-living crisis will remain with the BoE in the second half of the year. Accordingly, market expectations, which are witnessing a rise of about 175 basis points between now and the end of the year, seem exaggerated and pose significant downside risks to the pound towards the 1.15 support area.”

While the UK GDP figure surprised the markets, many economists still expected an economic contraction for the second quarter and the pound’s gains were in the wake of the short-term data, with the pound falling more rapidly than the dollar, which rose to new highs against many currencies.

Andrew Goodwin, economist at Oxford Economics, says: “We think May’s performance was interesting because there was one extra working day in that month. Monthly activity data is likely to remain highly volatile over the next few months, only stabilizing once we reach late summer.” “The Bank of England’s recent behavior has indicated that it prioritizes anti-inflation over supportive activity, so it appears that the MPC looks to be exercising a higher inflation potential than weak growth as it discusses whether or not to ramp up rate hikes at the August meeting,” he added.

Meanwhile, the US dollar gained in the wake of a large bullish US inflation surprise for the month of June and amid growing market concerns about the global economy. On the other hand, says Francesco Pesol, currency markets analyst at ING: “The cable appears in danger of moving to 1.1600-1.1700 in the coming days on the back of the strength of the US dollar.”

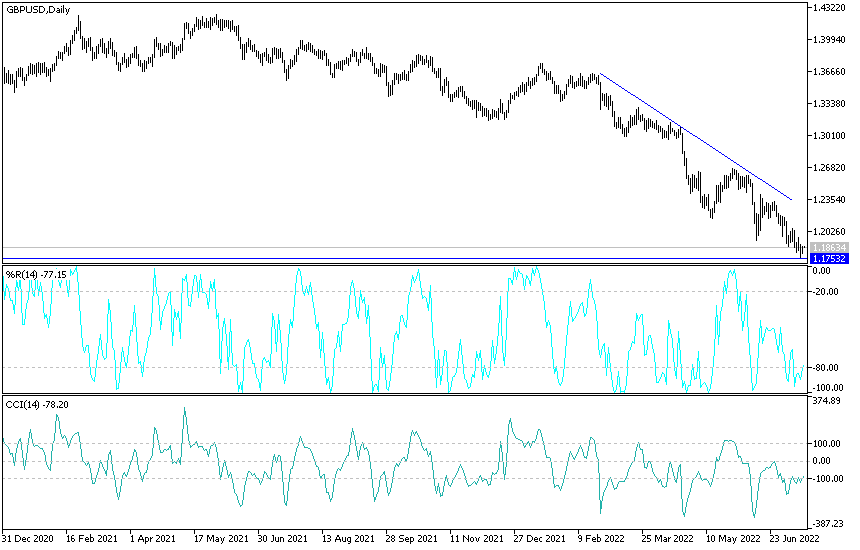

GBP/USD Technical Analysis

In the near term and according to the performance on the hourly chart, it appears that the GBP/USD is trading within an ascending channel formation. This indicates a significant short-term bullish momentum in market sentiment. Therefore, the bulls will look to extend the current gains by targeting profits at around the 1.1884 resistance or higher at the 1.1919 resistance. On the other hand, the bears will look to pounce on profits at around 1.1820 or lower at 1.1780.

In the long term and according to the performance on the daily chart, it appears that the GBP/USD currency pair is trading within the formation of a descending channel. This indicates a significant long-term bearish momentum in market sentiment. Therefore, the bears will look to extend the current declines towards 1.1728 or lower at 1.1586. On the other hand, the bulls will look to pounce on potential retracements around 1.2010 or higher at 1.2159.

Ready to trade our Forex daily analysis and predictions? Here are the best Forex brokers to choose from.

[ad_2]