Analysts say the price of gold may still try to bottom, but with markets pricing in monetary easing, the metals market could see some gains in the near term.

Gold futures extended their gains to end the disappointing month of July. The yellow metal has been under pressure since the US Federal Reserve began its tightening cycle, sending the US dollar higher.

Can gold prices touch $1800 again this month?

The price of gold XAU/USD rose to 1768 dollars an ounce, the highest in nearly a month. Accordingly, the price of gold recorded a weekly gain of about 3.6%, to reduce its loss over the course of 2022 to less than 3%. In the same way, silver, the sister commodity to gold, turned things around, topping $20 an ounce. As silver futures rose to $ 20.26 an ounce. Accordingly, the price of the white metal recorded a huge weekly gain of 8%, bringing its gains in July to 0.05%. Since the beginning of the year 2022 to date, the price of the white metal has decreased by about 13%.

In general, metallic commodities benefit from a weaker US dollar and lower Treasury yields.

The US Dollar Index (DXY), which measures the performance of the US currency against a basket of currencies, fell 0.35% to just below 106.00. Therefore, the index fell by 0.69% last week, but is still up by 10.45% since the beginning of the year. For July, the DXY US Dollar Index rose 0.8%.

A weaker price is beneficial for dollar-priced commodities because it makes them cheaper to buy for foreign investors.

Other Factors Affecting Metals

The US Treasury market was mostly in the red with the choppy trading week closed, with the benchmark 10-year yield dropping 5.6 basis points to 2.625%. One-year yields rose 2.3 basis points, while 30-year yields fell 6.3 basis points to 2.976%. Lower returns are good for gold because it reduces the opportunity cost of holding non-return bullion.

Ultimately, it is up to the Fed. With the US economy sliding into a technical recession, investors are excited about the possibility that the US central bank will be less aggressive about raising US interest rates in the future, something that Federal Reserve Chairman Jerome Powell hinted at the Federal Open Market Committee (FOMC) last week.

Analysts’ expectations for the gold price:

Analysts say the price of gold may still try to bottom, but with markets pricing in monetary easing, the metals market could see some gains in the near term. As for the prices of other metallic commodities, copper futures contracts rose to 3.565 dollars per pound. Platinum futures rose to $892.10 an ounce. Palladium futures rose to $2130.00 per ounce.

Technical analysis of gold prices:

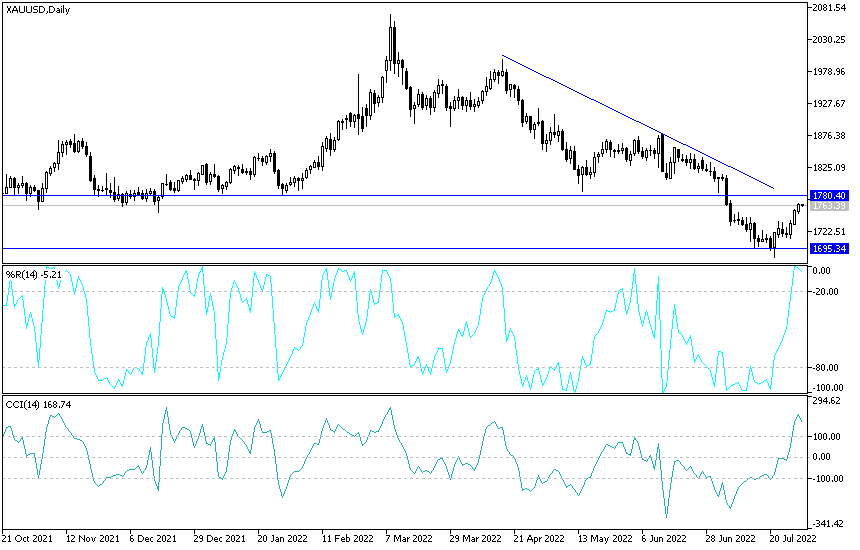

In the near term and on the hourly chart, it appears that the XAU/USD gold price is trading within a sharp bullish channel formation. This indicates a significant short-term bullish momentum in market sentiment. Therefore, the bulls will look to ride the current rally towards $1,771 or higher to $1,780. On the other hand, the bears will target short-term profits at around $1,760, or lower at $1,752.

In the long term and according to the performance on the daily chart, it appears that the price of XAU/USD is trading within the formation of a descending channel. This indicates a significant long-term bearish momentum in market sentiment. Therefore, the bears will look to extend the current declines towards $1,724 or lower to $1,628 an ounce. On the other hand, bulls will target long-term profits at around $1,806 or higher at $1,848 an ounce.

Ready to trade our Gold price forecast? We’ve made a list of the best Gold brokers worth trading with.