[ad_1]

Gold futures recorded modest gains at the beginning of trading this week, reaching the resistance level of 1937 dollars for an ounce, and settling around those gains in trading today, Tuesday. So far, investors are ostensibly buying traditional safe-haven assets in reaction to the recent news in Ukraine. Gold’s gains were capped by a boost in Treasury yields and a stronger US dollar. As talk of an economic recession escalates, can the price of the yellow metal re-test $1,950?

The price of gold retreated from a weekly gain of about 0.6%, which raised its rise since the beginning of 2022 to nearly 6%. Silver, the sister commodity to gold, is trying to stay positive. As silver futures rose to $24.71 an ounce. The price of the white metal has attempted to reach the top of $25 in overnight trading, but it is still close to 6% so far this year.

While there was optimism that Ukraine and Russia would speed up peace negotiations, the sad news made headlines over the weekend. It was reported that 410 civilians were found dead in towns near Kyiv, leading to European leaders calling for more sanctions against the Kremlin.

The developments forced Ukrainian President Volodymyr Zelensky to call it a “genocide”.

Meanwhile, investors are watching inflation data due next week. The US inflation report for March is widely expected to exceed 8%, which could force the Federal Reserve to push the trigger to raise US interest rates by 50 basis points next month. This could be a difficult thing for gold trading. On one hand, rising inflation will prompt investors to buy safe assets. But on the other hand, the precious metal is usually sensitive to higher interest rates because it raises the opportunity cost of holding non-yielding bullion.

The US Federal Reserve, and according to the CME FedWatch tool, most of the market expects a half-point increase at the Federal Open Market Committee (FOMC) meeting next month. The US Treasury market was mostly in the green at the start of this week, with the 10-year yield rising to 2.395%. The one-year bond yield rose to 1.688%, while the 10-year yield rose to 2.395%.

Another factor affecting the gold market is the rise in the price of the dollar, as the US dollar index (DXY), which measures the performance of the US dollar against a basket of other major currencies, rose to 98.91, from an opening at 98.63. The index fell 0.1% last week but is still up more than 3% since the beginning of the year. A consolidation value is bad for dollar-priced commodities because it makes them more expensive to buy for foreign investors.

In other metals markets, copper futures jumped to $4.7845 a pound. Platinum futures rose to $991.80 an ounce. Palladium futures advanced to $2,277.50 an ounce.

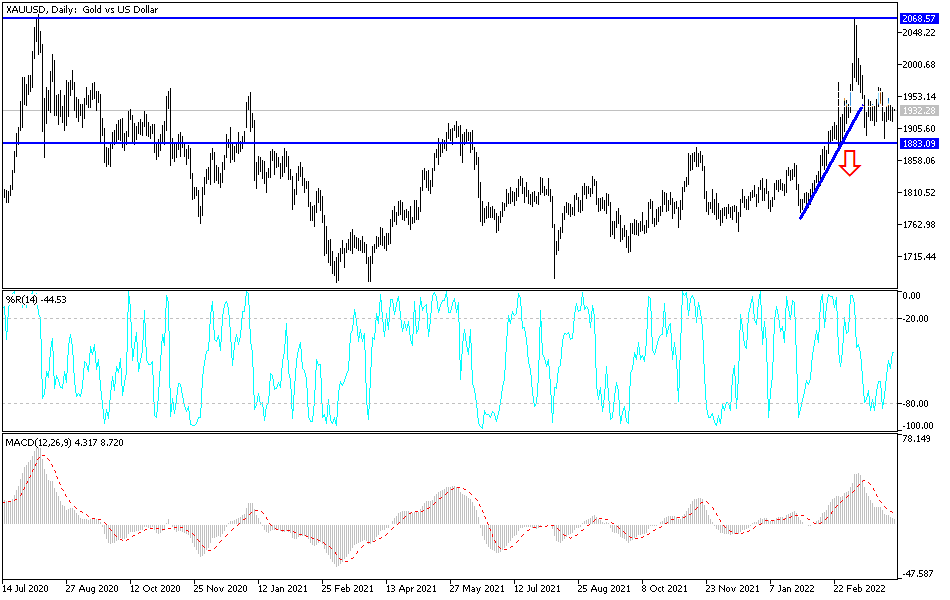

According to gold technical analysis: There is no change in my technical view of the future price of gold. So far, the gold market trend is still bullish as long as it continues to perform around and above the resistance of 1900 dollars. In the event that the bulls move towards the 1955 and 1970 resistance levels, expectations will return to the historical psychological resistance level of 2000 dollars an ounce again.

Overall, I still prefer buying gold from every bearish level as long as global geopolitical tensions and the pandemic persist. Gold still confirms that it is the most efficient safe haven in times of uncertainty. On the downside, the strength of the US dollar and investors’ appetite for risk may bring the price of gold some bearish pressure. According to the performance on the daily chart below, the psychological support of 1880 dollars will remain the most important.

[ad_2]