[ad_1]

During last week’s trading, gold futures struggled to record significant gains and did not exceed the resistance level of $1950. By the end of the week’s trading, it fell to the level of $1918 before closing the week’s trading stable around $1925 and began the new week’s trading near it. Gold’s losses were also driven by the strong jobs report in the United States of America and rising Treasury yields. Despite rising inflation, the yellow metal is facing pressure from the future of the Fed’s policy tightening to raise interest rates and the recovery of the economy.

Overall, gold prices experienced a weekly loss of 1.4% and recorded a monthly decrease of 2%. And from the beginning of 2022 to date, the price of the yellow metal is still up more than 5%. Silver, the sister commodity of gold, fell below $25, and overall the price of the white metal recorded a weekly loss of 3.3% and fell in March by more than 3%. Since the beginning of 2022 to date, silver prices are still high by about 6%.

All focus for financial markets on Friday was on the US jobs report for the month of March. According to the US Bureau of Labor Statistics (BLS), the US economy added a total of 431,000 new jobs in March and the unemployment rate in the country fell to 3.6%. The market expected a gain of 490,000 new jobs and an unemployment rate of 3.7%. Average hourly wages rose 0.4% to $31.73, average weekly hours decreased to 34.6, and labor force participation rate rose to 62.4%. The leisure and hospitality sectors led the US labor market in March, adding 112,000 jobs. Professional and commercial services have established 102,000, followed by retail (49,000) and manufacturing (38,000). Meanwhile, the number of unemployed people fell to less than six million, the number of people who could only find part-time work fell to 1.06 million, and the number of those who lost work fell to less than three million.

Overall, the recent data may support the Federal Reserve in raising US interest rates at the Federal Open Market Committee (FOMC) meeting next month. The US central bank is widely expected to raise the trigger by 50 basis points in May.

As a result, the US Treasury bond market is green across the board, with the benchmark 10-year bond yield rising to 2.384%. One-year yields rose to 1.722%, while 30-year yields rose to 2.447%.

Gold is generally sensitive to a higher interest rate environment because it increases the opportunity cost of holding bullion that is not yielding.

Although some market analysts dismissed the recession fears, both 2y and 10yr returns were inverted for the second time this week. Investors view this as a reliable recession indicator. On another influential level, the US Dollar Index (DXY), which measures the performance of the US dollar against a basket of major currencies, rose by 0.33% to 98.64, from the opening at 98.34. The index is on track for a weekly loss of about 0.1%, to trim the year-to-date jump to less than 2.8%. Generally speaking, a strong profit is a bad thing for dollar-priced commodities because it increases the cost of buying them for foreign investors.

In other metals markets, copper futures fell to $4.725 a pound. Platinum futures rose to $996.90 an ounce. Palladium futures rose to $2265.00 an ounce.

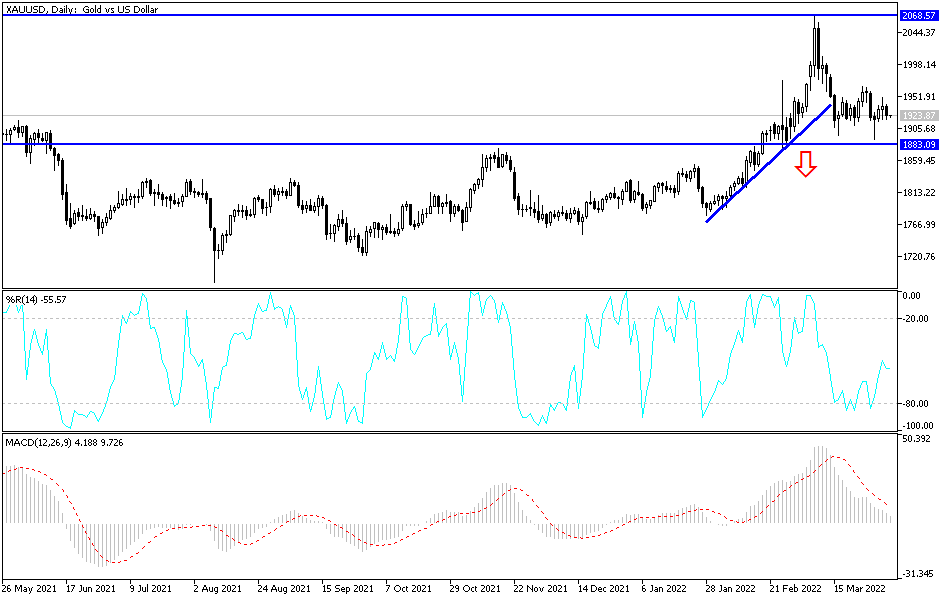

So far, the gold market trend is still bullish as long as it continues to perform around and above the $1900 resistance, and if the bulls move towards the $1955 and $1970 resistance levels, expectations are that gold will return to the historical psychological resistance level of $2000 again. I still prefer buying gold from every bearish level as long as global geopolitical tensions and the pandemic persist. Gold still confirms that it is the most efficient safe haven in times of uncertainty.

On the downside, the strength of the US dollar and investors’ appetite for risk may bring the price of gold some bearish pressure, and according to the performance on the daily chart below, the psychological support at $1880 will remain crucial.

[ad_2]