[ad_1]

Gold futures turned strongly positive, stunning many traders and analysts, as higher-than-expected US inflation sent investors to the safe-haven assets. The yellow metal continues to hold, despite the tightening of monetary policy by global central banks. With inflation raging across the US economy, the question now is: Will gold prices touch the top of $1,900?

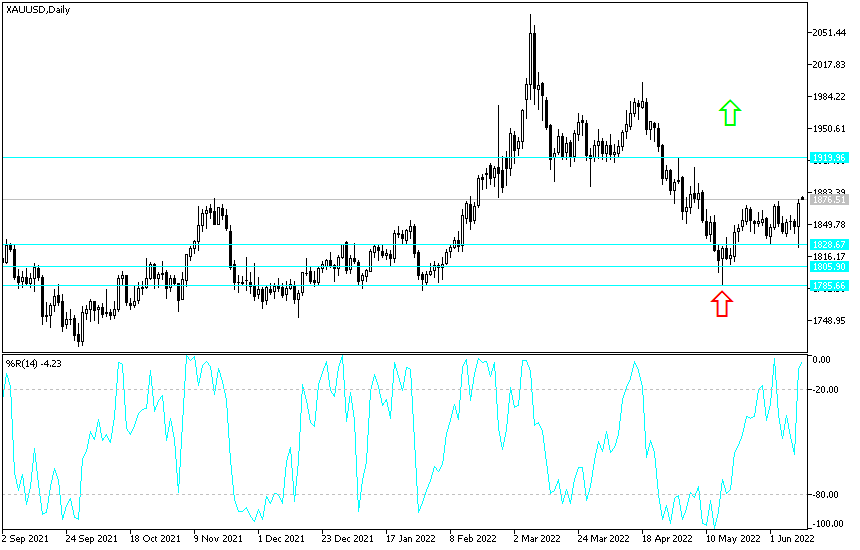

The price of gold rose to the resistance level of $ 1878 an ounce at the beginning of this important week’s trading after the top of $ 1876 an ounce on Friday. It was affected by the movement of the gold price to achieve weekly gains by 0.35%, in addition to its rise since the beginning of the year 2022 to date by about 1.6%.

In the same performance, the price of silver, the sister commodity to gold, also erased its losses after the sharp US inflation report. Silver rose to $21.855 an ounce. Accordingly, the price of the white metal is preparing for a weekly decline of 0.4%, which raises its loss since the start of the year 2022 to date to nearly 6.5%.

It was all about the US CPI report for May as the numbers came in higher than economists had expected, indicating that inflation has not peaked yet. According to the official announcement, in May, the annual inflation rate in the United States of America rose to 8.6%, higher than economists’ expectations of 8.3%. This was up from 8.3% in April. Core inflation, which strips out the volatile food and energy sectors, rose 6% year over year, slightly above market expectations of 5.9%.

On a monthly basis, the US Consumer Price Index (CPI) rose 1%, while the core CPI jumped 0.6%. Everything was up across the board, led by food (+10.1%), energy (+34.6%), used cars and trucks (+16.1%) and new vehicles (+12.6%). But clothing also increased by 5%, while shelter increased by 5.5%.

All eyes will now be on the Producer Price Index (PPI) this week as economists begin an annual reading of 10.9%, which will be slightly lower than the 11% reading in April. However, investors may be concerned that producer prices may again top market estimates.

Meanwhile, fiery inflation data has prompted financial markets to raise the odds that the Federal Reserve will raise US interest rates by 75 basis points at this week’s Federal Open Market Committee (FOMC) policy meeting, higher than the initial forecast of 50 basis points.

Last Friday the US Treasury market bonds jumped, with the benchmark 10-year yield rising 10.8 basis points. Investors are watching the rise of more than 18 basis points in the two-year bond, which is also nearing the 10-year mark, which could lead to a yield curve inversion. This is one of the main indicators of stagnation.

The gold market is usually sensitive to higher rates and returns because it raises the opportunity cost of holding non-returning bullion.

The strength of the US dollar limited gold’s gains as the US Dollar Index (DXY) advanced to 104.08 and the index, which measures the US currency against a basket of major currencies, will measure about 2% weekly support, adding to its 2022 year-to-date gains of about 8.5%. In general, a stronger profit is bad for dollar-priced commodities because it makes them more expensive to buy for foreign investors.

In other metals markets, copper futures fell 1.78% to $4.303 a pound. Platinum futures fell to $968.70 an ounce. Palladium futures were down 1.18% to $1,893.00 an ounce.

According to gold technical analysis: The bulls’ control over the gold market has increased in strength and has often been noted and recommended to buy gold from every descending level. This is despite the strong interest of global central banks towards raising interest. The gold market is still receiving momentum from other factors, most notably global geopolitical tensions led by the Russian war and the re-emergence of global concern about the Corona pandemic, which threatens the future of global economic recovery. The bulls’ move towards the $1882 resistance will support the move towards the next psychological resistance, $1900 an ounce.

A real change in the general direction of the gold price will not occur without moving towards the support levels of 1838 and 1820 dollars, respectively. So far, I still prefer buying gold from every bearish level. The gold market, like the rest of the global markets, is on an important date this week with the monetary policy announcements of a group of global central banks led by the US Federal Reserve.

[ad_2]