[ad_1]

During yesterday’s trading, the price of gold recorded the psychological resistance level of 1800 dollars per ounce, the highest in more than a month. It settled around the price of 1794 dollars per ounce, awaiting the announcement of the important US inflation figures for the expectations of raising interest rates by the US Federal Reserve. XAU/USD gold prices have risen over the past two weeks, despite the Fed’s tightening and potential signs that inflation may be easing.

In general, the price of the yellow metal increased by about 5% from last month, to reduce its loss since the beginning of the year 2022 to date to about 1%. At the same time, the price of silver, the sister commodity of gold, was unable to hold its gains. Silver futures fell to $20.485 an ounce. Overall, the price of the white metal is up nearly 8% this month, although it’s still down about 12% over the year.

Will Gold be affected by consumer reports?

Investors are awaiting the US Consumer Price Index (CPI) data for July. The market expects the annual US inflation rate to fall to 8.7%, down from 9.1% in June. Core inflation, which is decimating the volatile food and energy sectors, is expected to rise to 6.1% on an annual basis. The biggest reason for the possible drop in price inflation is due to the collapse in crude oil and gasoline prices. US crude oil prices are paring their gains after the invasion, while the price of gasoline is hovering near $4 a gallon. Meanwhile, last July’s strong US jobs report may force the Federal Reserve to rethink its aggressive tightening efforts. This will allow gold to take advantage of lower interest rates, making yield-bearing assets less attractive.

Factors affecting the gold market

The US Treasury market overall rose on Tuesday, with the benchmark 10-year bond yield rising 3.6 basis points to 2.799. One-year yields rose 1.6 basis points to 3.29%, while 30-year yields rose one basis point to 3.008%. Also, the spread between the two-year and ten-year yield has widened to -50 basis points. Declining yields are a bullish trend for gold as it reduces the opportunity cost of owning non-yielding bullion.

- The US Dollar Index (DXY), which measures the performance of the US currency against a basket of major currencies, fell to 106.29, from an opening at 106.44.

- The index is trading flat during the week, but is still up about 11% since the beginning of the year.

- A weaker price is beneficial for dollar-priced commodities because it makes them cheaper to buy for foreign investors.

- In other metals markets, copper futures settled at 3.5825 dollars per pound. Platinum futures fell to $931.10 an ounce. Palladium futures fell to $2,226.50 an ounce.

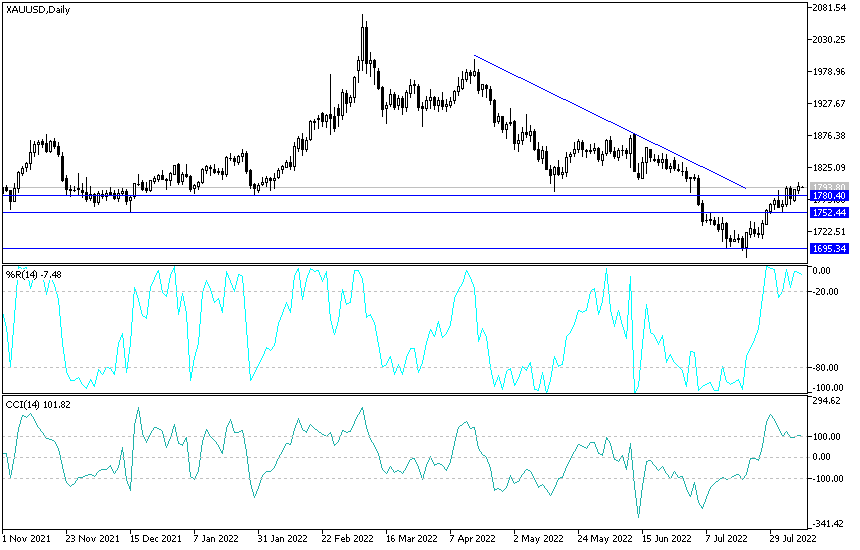

XAU/USD Gold Price Forecast Today:

The psychological resistance of 1800 dollars an ounce is still an important barrier for the bulls to control the direction of gold XAU/USD. As mentioned before, the stability above it will remain important to increase the technical buying deals towards the resistance levels of 1818 and 1835 dollars, respectively. These are levels that will support more bulls’ control over the direction of gold. The price of gold will remain in a limited range with an upward bias until the US inflation figures are announced later today, with positive and negative results for gold and vice versa. In general, I still prefer buying gold from every bearish level, and the closest support levels for gold are currently 1782 and 1760 dollars, respectively.

Ready to trade today’s Gold prediction? Here’s a list of some of the best Gold brokers to check out.

[ad_2]