[ad_1]

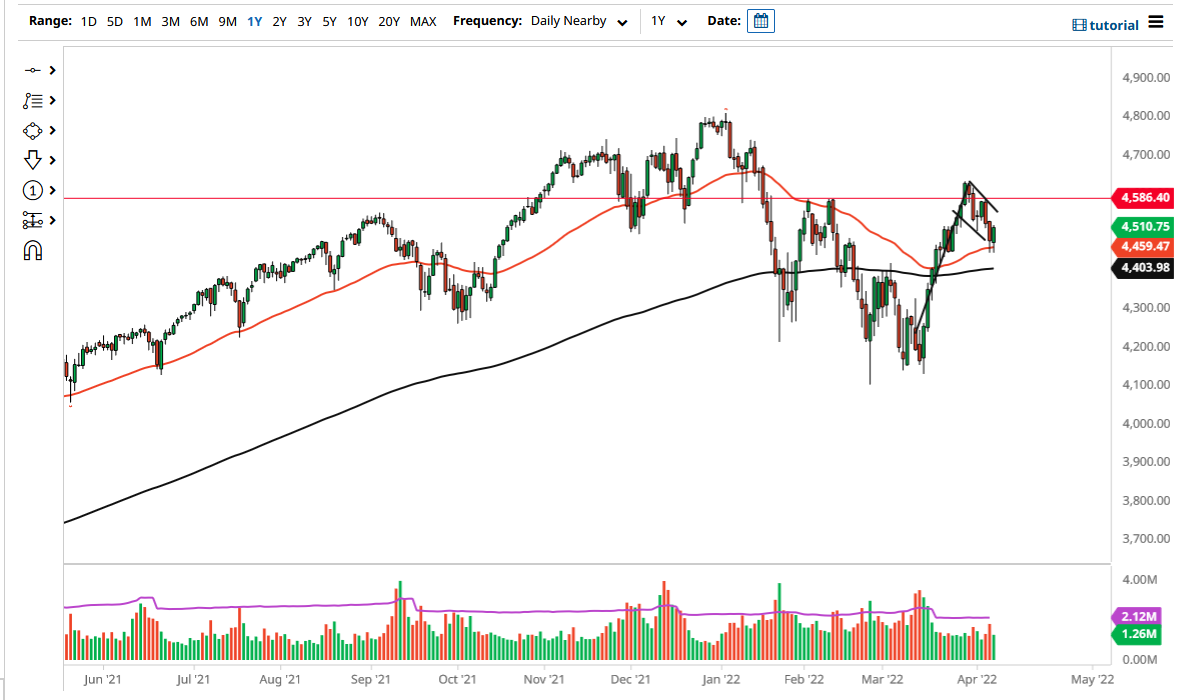

Now that we have tested the 50 Day EMA two days in a row and I found buyers there, I suspect that a bounce could be coming.

The S&P 500 has saved itself late during the trading session on Thursday, as the fabled “Plunge Protection Team” enter the market. Whether or not it was actually anybody at the Federal Reserve is a completely open question, because quite frankly there were a lot of technical reasons why this could have happened.

The first thing of course is the 50 Day EMA being tested, which generally attracts a certain amount of attention. Now that we have tested it two days in a row and I found buyers there, I suspect that a bounce could be coming. It did not look that way earlier in the session, and quite frankly I thought we could see a bit of selling. Now that we have turned around, it is obvious to me that the market refuses the fall, perhaps due to the fact that people are willing to challenge the Federal Reserve.

Keep in mind that this is about liquidity and nothing else and will have nothing to do with the overall economy. (The idea of the stock market and the economy being related was killed after the Great Financial Crisis.) Currently, there is a huge debate as to whether or not the Federal Reserve will be as aggressive with monetary policy as advertised. It is an interesting argument, and is going to continue to cause headaches for traders.

If they are not, that is good for stocks because they run on liquidity and nothing else. On the other hand, if they have to be tight because of inflation, that will be like a hammer to the stock market. A lot of it is going to come down to whether or not Wall Street gets its fair share of cheap money, in its eyes. Those days could be over, but it will be interesting to see whether or not that plays out.

The market has been forming a bullish flag, and the action during the trading session on Thursday saved that notion. I anticipate that they may try to push this market higher heading into the weekend, but there is going to be a certain amount of influence from Asia and Europe at the open. If they start to sell off again, we may fall to test the 200 Day EMA. I anticipate that by the time it is only North America trading, there will be buyers.

[ad_2]