[ad_1]

Today’s recommendation on the lira against the dollar

– Risk 0.50%.

– The buy order of yesterday’s recommendation was activated, and the stop loss point was moved as the price moved in the direction of profit

Best buy entry points

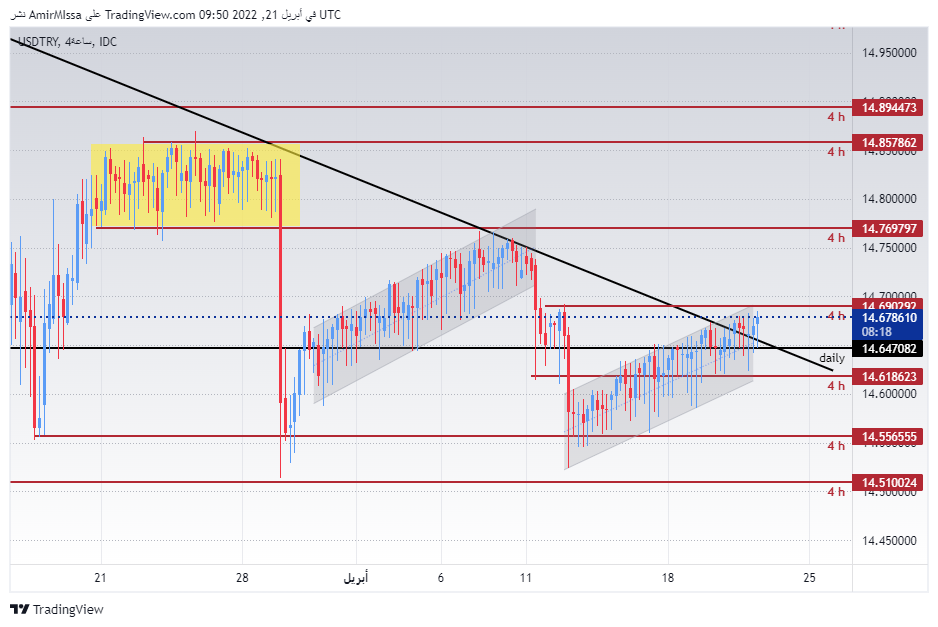

Entering a long position with a pending order from 14.62 levels

– Set a stop loss point to close the lowest support levels 14.46.

– Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

Close half of the contracts with a profit equal to 75 pips and leave the rest of the contracts until the strong resistance levels at 14.85.

Best selling entry points

Entering a short position with a pending order from 14.86 . levels

– The best points for setting the stop loss are closing the highest levels of 14.98.

– Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

Close half of the contracts with a profit equal to 75 pips and leave the rest of the contracts until the support levels 14.40

Turkish lira declines after early data, the consumer confidence index fell to its lowest level in 12 years. This is with the rise in inflation significantly in the country, as it exceeded its highest levels in 20 years, after recording levels exceeding 61 percent. The weakness of the Turkish lira, which lost nearly 44 percent of its value over the past year, also contributed. pressure on consumer confidence. In general, the weak data contributed to the decline in living standards, making foreign imports more expensive for citizens. Financial expectations over the next year also fell to 63.9 points. The economic numbers and the data that continue to reflect the not good conditions in Turkey.

On the technical front, the Turkish lira declined slightly against the dollar during today’s trading, as the US dollar pair against the Turkish lira maintained its trading within a narrow trading range, which is evident on the chart. The pair is currently trying to surpass the descending trend line on the 240-minute time frame, shown on the chart. The pair also varied around the 50, 100 and 200 moving averages, respectively, on the four-hour time frame, while trading above the same averages on the 60-minute time frame. The pair is trading the highest support levels that are concentrated at 14.60 and 14.45 levels, respectively. On the other hand, the lira is trading below the resistance levels at 14.68 and 14.75, respectively. We expect the lira to decline as long as the pair does not break the bottom recorded during last week. In the event of breaching 14.68 levels and closing the highest levels of the descending trend line, this will lead to an increase in the losses of the Turkish lira. Please adhere to the numbers in the recommendation with the need to maintain capital management.

[ad_2]