We expect a continuation of the lira’s decline until the mentioned resistance levels.

Today’s recommendation on the lira against the dollar

Risk 0.50%.

Yesterday’s sell trade was activated and reached the stop loss point

Best buy entry points

- Entering a long position with a pending order from 14.88 levels

- Set a stop-loss point to close the lowest support level 14.46.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 75 pips and leave the rest of the contracts until the strong resistance levels at 14.85.

Best selling entry points

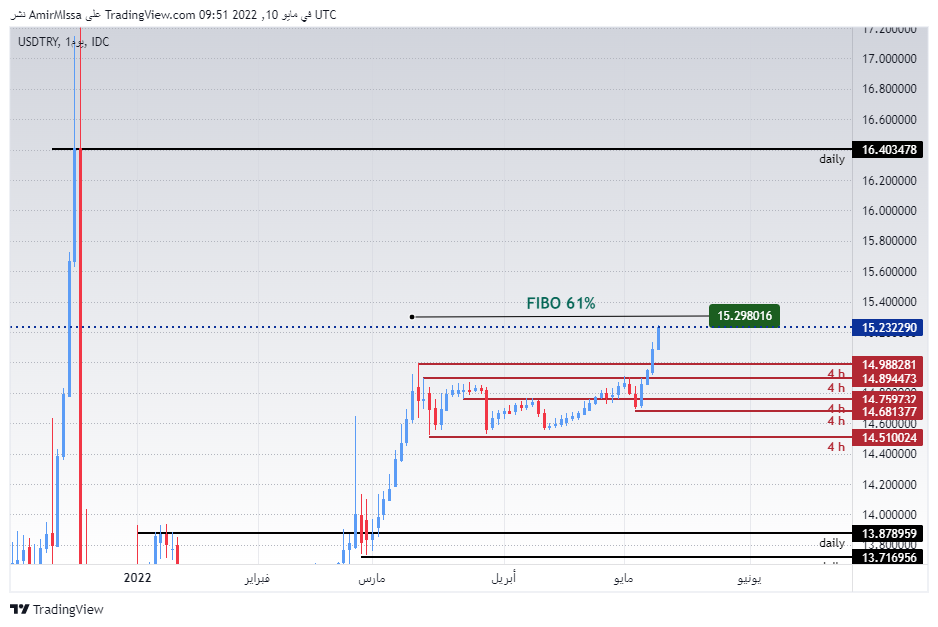

- Entering a short position with a pending order from 15.29 levels

- The best points for placing a stop loss are closing the highest levels of 15.08.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 75 pips and leave the rest of the contracts until the support levels 14.88

Turkish lira continues to decline against the US dollar, the lira recorded its lowest level this year, amid a strong decline in emerging market currencies and financial assets in general against the US dollar. Yesterday, most financial assets recorded strong declines as the stock markets, precious metals, cryptocurrencies, major currencies, and of course emerging market currencies declined. In light of the US Federal Reserve maintaining the policy of tightening against the policy of easing followed by the Turkish Central Bank, where the interest rate was fixed after cutting it by about 5 percent during the past year. The Turkish lira recorded a decline of about 40 percent during the past year, before regaining its balance at the end of the year, after which it began to decline at a weak pace.

On the technical level, the Turkish lira fell strongly against the dollar during yesterday’s trading, as the Turkish currency continued to decline to break the limited trading range in which the currency settled for a long time. The pair continued to rise above the moving averages 50, 100 and 200, respectively, on the four-hour time frame as well as on the 60-minute time frame. At the same time the pair is trading the highest levels of support, which are concentrated at 14.99 and 14.87 levels, respectively. On the other hand, the lira is trading below the resistance levels at 15.29 and 15.50. The pair targets 15.29 levels, which represents the 61 Fibonacci level of the descending wave that recorded its top on 12/21-2021 and recorded its bottom on 12/23-2021. We expect a continuation of the lira’s decline until the mentioned resistance levels. Please adhere to the numbers in the recommendation with the need to maintain capital management.