[ad_1]

I think it’s paramount that you are cautious with your position size.

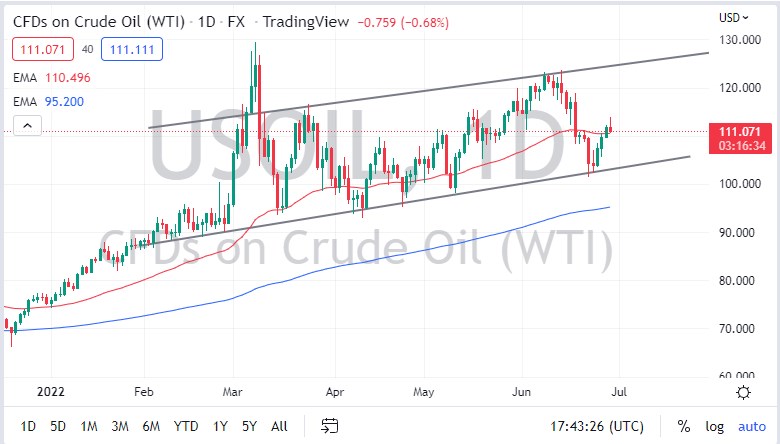

The West Texas Intermediate Crude Oil market initially rallied on Wednesday but gave back gains to form a bit of a shooting star. Because of this, the market looks as if we are going to continue to see a bit of a fight, and it is probably worth noting that the crude oil market is one of the last remaining bullish markets out there as far as growth is concerned. Most other commodities have gotten hammered in this environment, as we are starting to worry about some type of global recession.

When you look at this chart, you can see that we are sitting just above the 50-day EMA, which is an indicator that a lot of people will pay attention to. By breaking above there, it does suggest that we have a bit of momentum on our side again, but the fact that we get back so much in the way of gains does show that there is a little bit of hesitation.

There is the channel that I have drawn on the chart that you need to pay attention to, so if we were to break down below that level, then it’s likely that we will go much lower. The $100 level underneath will attract a lot of attention, so it’s likely that there will be an attempt to recover. If we break down below that level, then it’s likely that we could go much lower, perhaps leading crude oil markets much lower, as we have seen in copper and wheat markets.

If we were to break above the top of the candlestick, then it’s possible that we go looking to reach the $120 level above, an area that has been resistant. If we were to break above that level, then it’s likely that we could go much higher. That being said, even though there are concerns about the supply of crude oil, if the world is about to enter some type of global recession, it will certainly have a negative influence on the price of oil. I think at this point we are seeing a lot of negativity that’s going to continue to cause major issues, so I think it’s paramount that you are cautious with your position size, and be aware of the top of the daily range, and the uptrend line underneath.

[ad_2]