[ad_1]

This is an area that we need to be watching closely so I would keep my position size reasonable, as the market dictates.

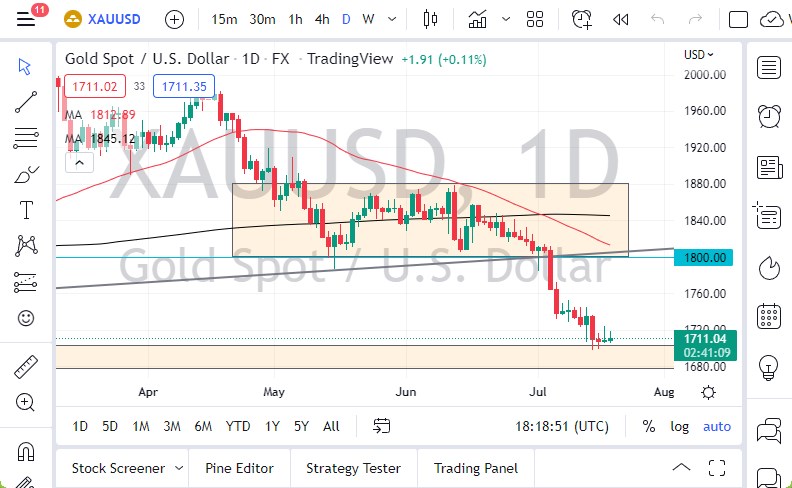

Gold tried to rally on Tuesday, but as you can see, we have given up gains yet again. We have formed a second inverted hammer candlestick, and this suggests that eventually, we are going to try to break through the $1700 level. You should keep in mind that the $1700 level is a large, round, psychologically significant figure, and an area where we have seen a lot of support multiple times over the last several years.

Looking at this chart, it’s obvious that the market is going to continue to see a lot of volatility and a lot of downward pressure, but you should also be aware that that support level underneath the $1700 level is more of a “zone” of support than anything else. That zone should extend down to the $1680 level. If we were to break through all of that, this market more likely than not will completely collapse, showing quite a bit of negativity.

If we were to break above the top of a couple of candlesticks from the last couple of days, we could get a bit of a rally and try to go looking to the $1750 level. The $1750 level is significant resistance, and if we can break above there, then it’s possible that the market could challenge the $1800 level. While I don’t necessarily think we will do that, it is a potential rally point. At that level, we need to pay close attention to price action, because if we see some type of exhaustion, it’s more likely than not you will see this market break down. However, if we were to turn around and break above the area, that could kick off a bigger return and rally.

Because of this, I will be paying close attention to this as a trend-defining level. I believe this is a market that is more of a “fade the rally” type of situation going forward, especially as yields in America in the US dollar both appear to be very strong. As long as that’s the case, gold is going to struggle going forward, as it is very sensitive to both of those inputs. Regardless, this is an area that we need to be watching closely so I would keep my position size reasonable, as the market dictates.

Ready to trade today’s Gold forecast? Here are the best Gold brokers to choose from.

[ad_2]