[ad_1]

Quiet trading sessions with a bearish bias is what is described as the performance of the EUR/USD currency pair recently. The EUR/USD is stable around the 1.0210 level at the time of writing the analysis. As I mentioned at the beginning of this week’s trading, the euro-dollar may move in narrow ranges until the US inflation figures are announced, the main driver of the markets this week. The US dollar this week got a strong impetus from the US jobs numbers, which support the tightening path of the US Federal Reserve’s policy.

What is expected for the EUR/USD in the coming days?

The EUR/USD exchange rate is expected to fall back below 1.0 in the coming weeks, according to analysts at Rabobank, the international lender and Dutch investment bank. The new analyses indicate that the US dollar will likely remain well supported until 2023, a view that contrasts with that of some analysts who say we are at a turning point with the end of the dollar’s multi-month rally.

This view is supported by the recent consolidation in the EUR/USD which fell below parity in mid-July but has since recovered and consolidated between 1.01 and 1.03. “The market will now be looking for a new direction,” says Jane Foley, chief forex analyst at Rabobank in London. “For this to happen, the strength of the US dollar will likely be complemented by another bout of fresh negative news for the euro.”

Euro Catalysts

Rabobank sees the following factors as likely to trigger another sustainable sell-off in the Euro:

- A harsh winter for Europe.

- They see the prospects for a recession in the Eurozone strong.

- Since rising energy prices are a major headwind for businesses and consumers.

- Cold winter with possible full gas shutdown across Nord Stream 1 .

“We continue to see further potential declines in the euro from 1 to 3 months,” the bank’s analyst added. “Coincidentally, we expect the US dollar to remain well supported in this period.”

US dollar motivators.

Rabobank sees the following factors helping the US dollar:

- It seems that the Federal Reserve is ready to announce a 75 basis point rate hike on September 21st.

- This is a result of the strong US labor market report last week for the month of July.

- The US dollar is also likely to find support from safe haven demand.

Accordingly, the analyst added, “The US dollar is the most billed currency in the world by a wide margin. This means that a strong green currency tends to have a negative effect on trade.”

Another risk to global economic growth is slowing demand for goods from China. Accordingly, the analyst says, “In our view, the value of the US dollar is likely to remain stable until the risky currency environment improves. This suggests that there is room for the US dollar until 2023.” He added, “Although we expect the EUR/USD 1.01 area to act as a strong support going forward, we maintain the view that the EUR/USD is likely to fall back below parity again in a spectacle of 1 to 3 months.

EUR/USD analysis:

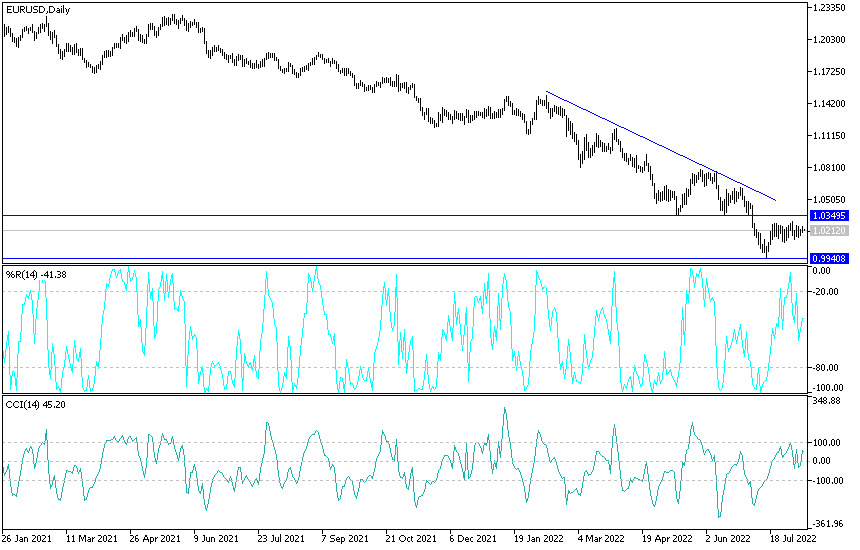

There is no change in my technical view of the performance of the EUR/USD pair until the announcement and the reaction from the US inflation figures today – the consumer price index – which will have an impact on the expectations of raising US interest rates. According to the performance on the daily chart, the decline of the Euro-dollar below the support level 1.0140 will support the bears to move further downward and does not rule out the parity price with it. On the upside, without a test of the 1.0330 and 1.0400 resistance levels, the bulls won’t have a strong chance to take control. I still prefer to sell EURUSD from every bullish level.

Ready to trade our daily Forex analysis? We’ve made a list of the best Forex brokers worth trading with.

[ad_2]