[ad_1]

We are going higher over the longer term.

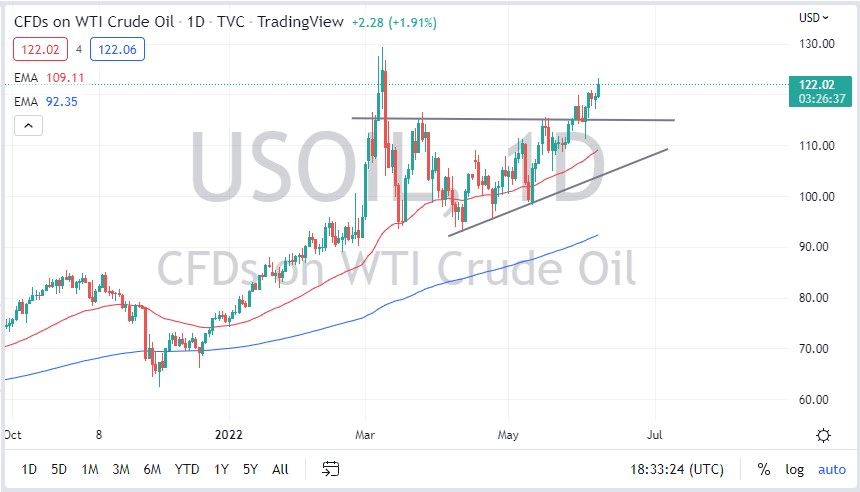

The West Texas Intermediate Crude Oil market rallied rather significantly on Wednesday as we see plenty of buying pressure in this market. In fact, it looks as if we have now cleared the $120 level quite neatly, and it looks like we are ready to go much higher. After all, demand for energy should continue to pick up and we have major issues when it comes to supply.

The market will continue to be very noisy, but I think that there would be plenty of buyers willing to come back into this market and pick up value every time it dips. After all, the $115 level should be a nice support level, as it was the top of the recent triangle that we broke out of. In fact, when we first broke out of the triangle, we pulled back into the $115 level before turning around and rallying.

You can see that the 50-day EMA is approaching the $110 level rather quickly, so I think that will be where we define the trend in general. Having said that, it looks very much like the market is willing to look at the previous triangle as a measuring stick, which could send this market all the way up to the $135 level. That does not mean that we will get there overnight, but it does make for a longer-term target. Because of this, I think that there will be plenty of people willing to get involved, especially if we continue to see issues with the Russian supply, which is something that seems to be a given.

Things have gotten so bad that Joe Biden has recently reached out to the Saudis to beg for oil. Interesting, considering that the United States is the world’s largest producer of oil just two years ago, but the failed green policies seem to be reversing that course. Because of this, it will come down to whether or not OPEC chooses to give up profits. Until we see significant demand destruction, it seems to be very unlikely that we will fall for a significant amount of time, be it from the supply/demand imbalance, or OPEC choosing to bring prices down by flooding the market. In other words, we are going higher over the longer term.

[ad_2]