[ad_1]

The price of gold crept higher as investors started the countdown to the conclusion of the main Federal Reserve meeting where US interest rates are expected to rise significantly. The price of gold rose to the level of 1728 dollars an ounce before settling around the 1717 dollars an ounce at the time of writing the analysis. Investors are pricing in a 75 basis point increase at the Federal Reserve’s July 26-27 meeting, although the outlook after that is difficult to predict.

Market participants have played down the amount of tightening needed to tame inflation, which is the Fed’s current priority, according to Bloomberg Economics, which anticipates a steeper and higher path for the federal funds rate.

Overall, the XAU/USD gold price is set for a fourth consecutive monthly loss, after falling to its lowest level since March 2021 last week as central banks tightened monetary policy to contain price pressures. While this raised fears of an economic slowdown, gold’s safe-haven appeal has been eroded by the dollar’s strength, despite the dollar’s slump from a record low in mid-July.

Commenting on the performance, Nicholas Frabel, an analyst at ABC Refinery in Sydney, said: “The US dollar is far from its highs and that may help the gold supply.” And “So far, gold’s rallies are not entirely convincing, and investors are waiting for the Federal Reserve meeting to get more information.” Instructions.”

The GDP data for the second quarter due tomorrow, Thursday, will indicate whether the United States of America is in a technical recession, although the administration of US President Joe Biden downplays the importance of the report.

Stock Market Analysis

US stocks fell after weak economic numbers and weaker expectations from the world’s largest retailer, underlining the effects of inflation pressures on consumer spending, with recession fears spreading as the US Federal Reserve prepares to deliver another massive increase. Investors are also bracing for another 75 basis point hike by Fed officials on Wednesday, with a combined 150 basis point increase through June and July marking the biggest rate hike since the early 1980s when then-chairman Paul Volcker was battling high inflation. Dim views of the economy have pushed US consumer confidence to its lowest level since February 2021, while the gauge of new home sales has fallen for the fifth time this year.

Today’s XAU/USD Gold Price Forecast:

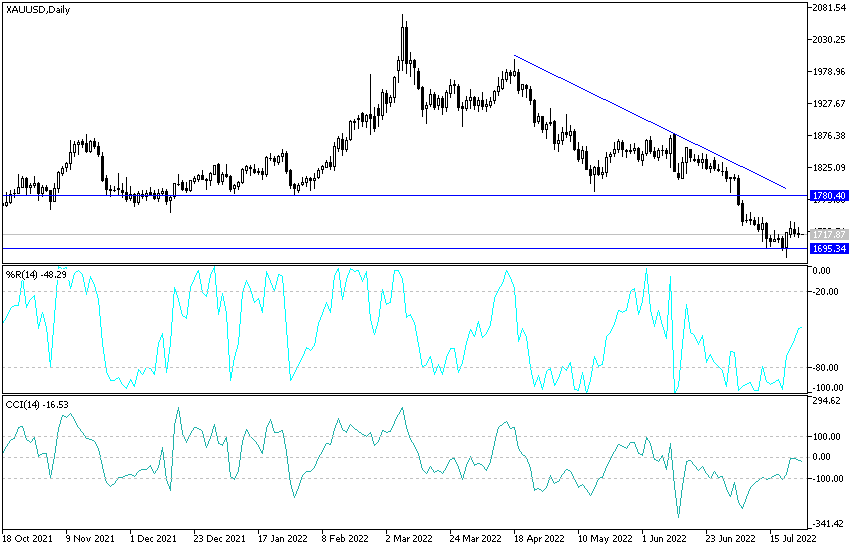

So far, the attempts of the XAU/USD gold price to recover to the top are still weak and the gold market lacks the momentum to get out of the current downtrend, which is characterized by moving towards and below the support level of 1700 dollars an ounce. As I mentioned before, gold price attempts to recover will not succeed without moving towards the resistance levels of 1755 and 1778 dollars, respectively, and the last level is important to move towards the psychological resistance level of 1800 dollars an ounce.

On the other hand, stability below the $1700 support level will move the gold price towards stronger support levels, from which buying may be considered, the most important of which are currently 1685 and 1660 dollars, respectively. The events of today and tomorrow will have a strong and direct reaction to the gold market, so caution should be exercised.

Ready to trade our Gold forecast? We’ve shortlisted the best Gold brokers in the industry for you.

[ad_2]