[ad_1]

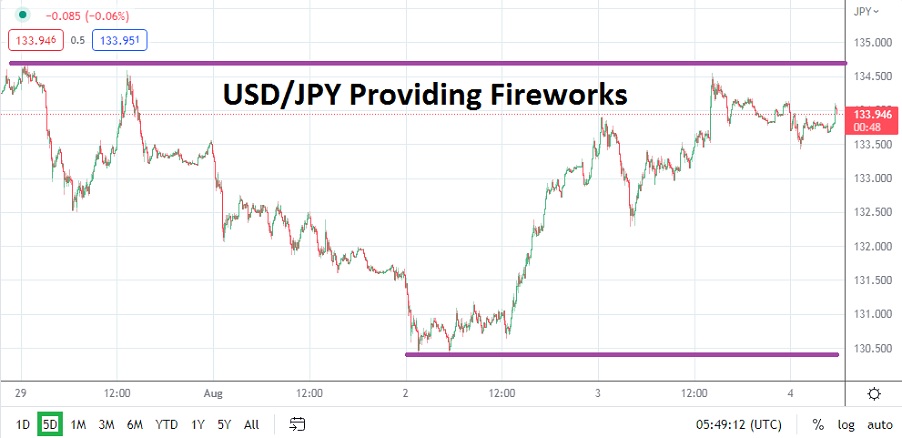

The USD/JPY has reversed upwards after hitting depths early this week that had not been seen since the first week of June.

As of this writing the USD/JPY is traversing close to the 134.200 mark in rather quick trading. After hitting a low of nearly 130.400 on early Monday morning – a value last seen on the 6th of June, the USD/JPY currency pair has risen in value. Traders who thought the perceived ‘overbought’ days of the USD/JPY were coming to an end, and wagered on a one way direction downwards should pause to reconsider their strategy.

The yen is a popular asset during turbulent times.

Technical Charts are Important, but Central Bank policies Matter and Uncertainty Remains

The ability of the USD/JPY to rapidly gain the past couple of days and the knowledge it is approaching important resistance levels again should cause contemplation for speculators who were convinced strong reversals higher would cease. Yes, on the 27th of July the USD/JPY was trading near the 137.480 realm before financial houses reacted to the interest rate hike from the U.S Federal Reserve. The selloff which followed was strong, but perhaps it was too strong.

- The upwards trajectory displayed the past few days of trading shows nervous sentiment remains sizeable regarding the USD/JPY, as a lack of clarity about U.S central bank policy stays murky.

- Tomorrow’s Average Hourly Earnings data from the U.S should be monitored and may have an effect on USD/JPY trading conditions.

If the USD/JPY can maintain its current values near the 134.000 level, this consolidation may be a sign financial houses are awaiting more insight from U.S data on the schedule tomorrow. Yes, the Non-Farm Employment Change numbers are due Friday, but it is the earnings data which should be watched closely.

If the hourly pay statistics comes in stronger than expected, the U.S Fed will have little choice but to remain hawkish regarding its interest rate policy. U.S Manufacturing and Services PMI data has been stronger than expected already this week.

Traders should not Expect Consolidation to Remain and Volatility is Likely

The USD/JPY could find a retest of the 133.750 to 133.250 values easily with reversals lower. However, while U.S data stands in the shadows which could signal ‘the need’ for additional actions from the U.S Federal Reserve, financial houses may not be large sellers. The opportunity to look for slight reversals lower and place a buying position by day traders may prove enticing for short term wagers looking for upside. The near term is likely to provide additional fireworks for USD/JPY traders and further moves higher may be demonstrated.

USD/JPY Short-Term Outlook

Current Resistance: 134.350

Current Support: 133.690

High Target: 134.970

Low Target: 131.120

Ready to trade today’s Gold forecast? Here are the best Gold brokers to choose from.

[ad_2]