[ad_1]

We expect the price to rise from the current levels or the closest levels of support.

Today’s recommendation on the lira against the dollar

Risk 0.50%.

The buy trade of the recommendation was activated on Thursday and reached the stop loss point.

The sell trade of Wednesday’s recommendation was activated and the target was fully reached.

Best selling entry points

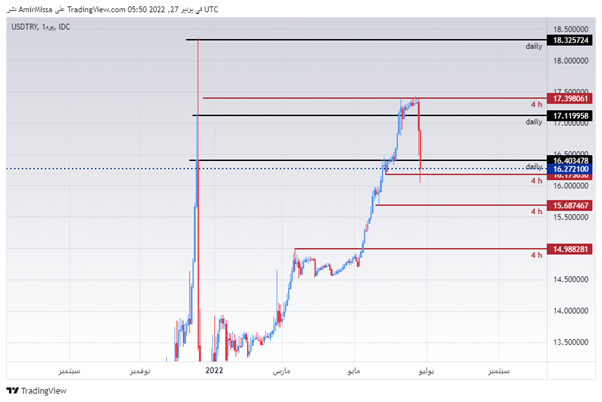

- Entering a short position with a pending order from levels 17.45

- Set a stop loss point to close the lowest support levels 17.65.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 55 pips and leave the rest of the contracts until the strong resistance levels at 16.40.

Best entry points buy

- Entering a buy position with a pending order from levels of 15.70

- The best points for setting stop-loss are closing the highest levels of 15.48.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 55 pips and leave the rest of the contracts until the support levels 16.40

The lira rose strongly during trading on Friday, to complement its strong rise against the dollar, with the markets returning to trading on Monday. The lira’s gains expanded after government measures issued last Friday regarding lending to companies that have income in hard currency. The Turkish government decided to stop loans to companies with foreign liquidity of approximately 980,000 dollars, or the equivalent of 15 million liras. This is except for specific conditions, including the purchase of euros or investment in protected deposit accounts in foreign currencies. The lira, which recorded strong losses during the second quarter of this year, woke up after promises from President Erdogan of further cuts in interest rates. The country’s inflation rate also rose to 73.5 percent during the month of May, causing the Turkish currency to lose about 20 percent of its value this year after losing 40 percent of its value last year. It is noteworthy that this measure has already had a strong impact in contrast to a number of measures taken by the Turkish Central Bank and the Ministry of the Treasury in the country

On the technical front, the Turkish lira jumped against the US dollar, as it broke the narrow trading range between 17.19 and 17.33 lira by a large margin. The pair reverses the general upward trend, with the pair trading support levels that are concentrated at 15.70 and 15.00, respectively. The pair also turned lower than the moving averages 50, 100 and 200, respectively, on the four-hour time frame, as well as on the 60-minute time frame, indicating a decline in the medium term. The pair bounced from the moving average 50 on the daily time frame. At the same time, the lira is trading below the resistance levels at 16.40 and 17.10, respectively. The pair is trading at strong support levels represented by the 50 Fibonacci levels on the ascending wave that starts from 03-05-2022 until the top recorded on 06-21-2022. We expect the price to rise from the current levels or the closest levels of support shown through the recommendation numbers. Please adhere to the numbers in the recommendation with the need to maintain capital management.

[ad_2]