[ad_1]

AVAX/USD has moved slightly higher in the last day of trading, but Avalanche remains near dangerous lows in a market that shows growing nervousness.

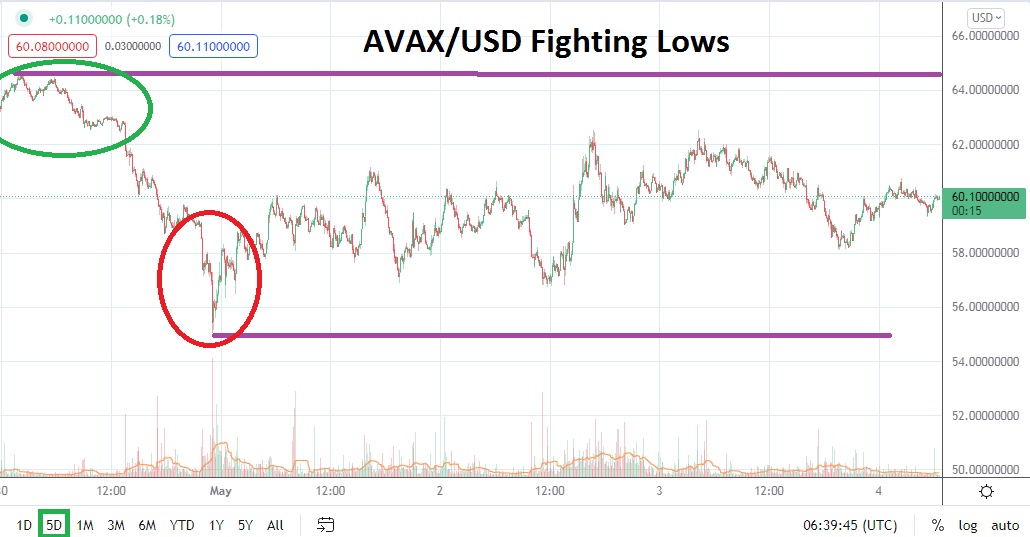

AVAX/USD is near the 60.25000000 ratio as of this writing having moved slightly higher in recent trading. However, the slight move upwards does not mask the slide downwards that AVAX/USD has produced the past month and its inability to establish a solid reversal higher. The lack of capability to sustain a move upwards mirrors the results from the broad cryptocurrency market and AVAX/USD is near important psychological support levels.

On the 2nd of April AVAX/USD was trading slightly below the 103.00000000 mark, the loss of value the past month has been dramatic for Avalanche. The bearish trend has proven strong and traders who have been tempted to look for long lasting moves higher to develop have likely experienced rather costly results within their trading accounts. As Avalanche trades within the 60 to 61 USD price realms, traders need to consider long term technical charts to grasp the dangerous price vicinity AVAX/USD looms.

If the 60.00000000 mark is shown to be vulnerable, traders cannot be blamed for believing lows seen only a few days ago will be displayed again. On the 30th of April and 2nd of May the 56 USD ratio was tested by AVAX/USD. The last time these current price realms of AVAX/USD were traded was in the last week of January. This value vicinity was also seen in October of 2021.

Traders who believe AVAX/USD may move lower cannot be faulted. Certainly the price of Avalanche may feel as if it has been oversold. But lower depths have been seen before, and if current support levels fail to hold it is not outside the realm of possibility that the 55 to 54 USD mark for Avalanche could be experienced again. The broad cryptocurrency market is exhibiting widespread nervousness and many of the major digital assets are testing important lows.

The bearish trend in AVAX/USD has failed to produce a significant reversal higher which could change the sentiment of most day traders. While looking for upside may be a wager some speculators want to make, these bets may prove to be best served by quick hitting trades that use take profit orders to cash out lightning quick results, otherwise they could prove to be expensive losing bets.

Traders on the other hand who remain skeptical of a sudden turnaround in AVAX/USD developing near term, may want to continue pursuing downside momentum which has been rather strong. Selling AVAX/USD and looking for support levels to be tested and used as take profit junctures may be worthwhile wagers short term.

Avalanche Short-Term Outlook

Current Resistance: 61.10000000

Current Support: 59.42000000

High Target: 63.46000000

Low Target: 54.24000000

[ad_2]