[ad_1]

Today’s recommendation on the lira against the dollar

Risk 0.50%.

Yesterday’s buy trade was activated, and half of the contracts were closed with the price rising towards the target and providing a stop loss point.

Best selling entry points

- Entering a short position with a pending order from levels of 18.33

- Set a stop-loss point to close the lowest support levels at 18.55.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 55 pips and leave the rest of the contracts until the strong resistance levels at 17.70.

Best entry points buy

- Entering a buy position with a pending order from levels of 17.85

- The best points for setting stop-loss are closing the highest levels of 17.54.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 55 pips and leave the rest of the contracts until the support levels 18.31

Turkish Lira Economic Outlook

The lira did not benefit from the dollar’s weakness after the Federal Reserve’s decision yesterday to raise interest rates by 75 points as expected, which the markets have already priced in. Jerome Powell’s comments also increased pressure on the dollar’s price, which fell against most of the major currencies since yesterday. The Federal Reserve Chairman said that the bank will slow down the pace of raising the interest rate in the United States, which benefited all financial assets such as stock markets, gold and cryptocurrencies as well as currencies that jumped against the US dollar. However, the economic conditions experienced by the economy in Turkey, especially the high inflation, which exceeded its highest levels in about 25 years. This was especially with the rise in the bill for energy imports and the depletion of the cash reserves with the Turkish Central Bank and the adoption of a special stimulus policy with the fixing of the interest rate about 10 months ago. This may make the Turkish lira price improvement unattainable.

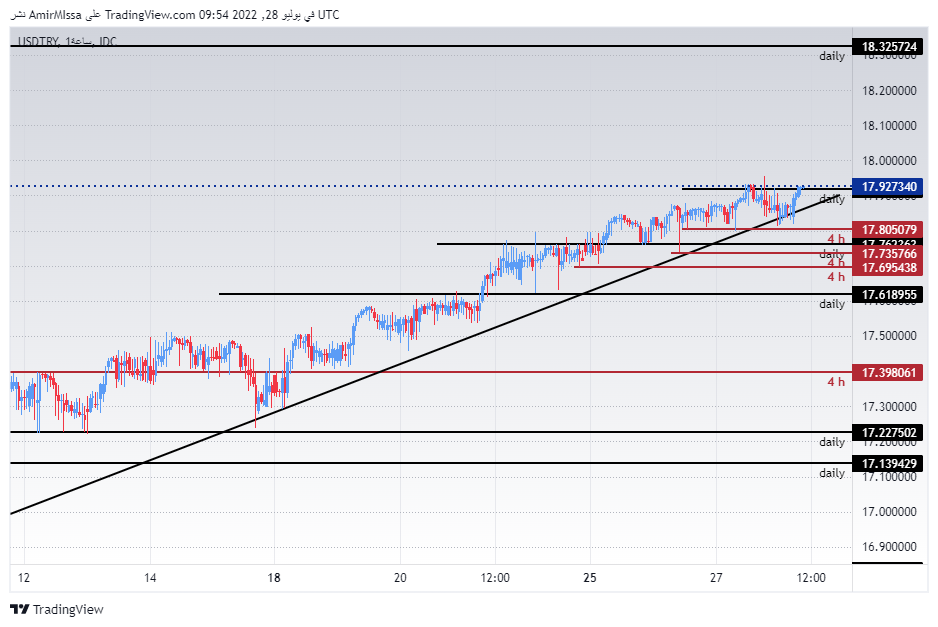

Technical Outlook USD/TRY

The Turkish lira fell against the US dollar, as the pair returned to its attempt to reach the top recorded during the current year, after a temporary decline during yesterday’s trading. The pair failed to break the ascending trend line on the four-hour time frame shown on the chart, at the same time the pair is trading the highest support levels that are concentrated at 17.80 and 17.70 levels, respectively. Meanwhile, the lira is trading below the resistance levels at 18.00 and 18.32, respectively. The pair is also trading above the moving averages 50, 100 and 200 on the four-hour time frame as well as on the 60-minute time frame, indicating the bullish trend on the medium term. We expect to re-record new highs, especially with every dip in the pair, which represents a buying opportunity. Please adhere to the numbers in the recommendation with the need to maintain capital management.

Ready to trade our daily Forex signals? Here’s a list of some of the best Forex trading platforms to check out.

[ad_2]