Small positions that you build on when they work out in your favor will probably be the best way to attack this market.

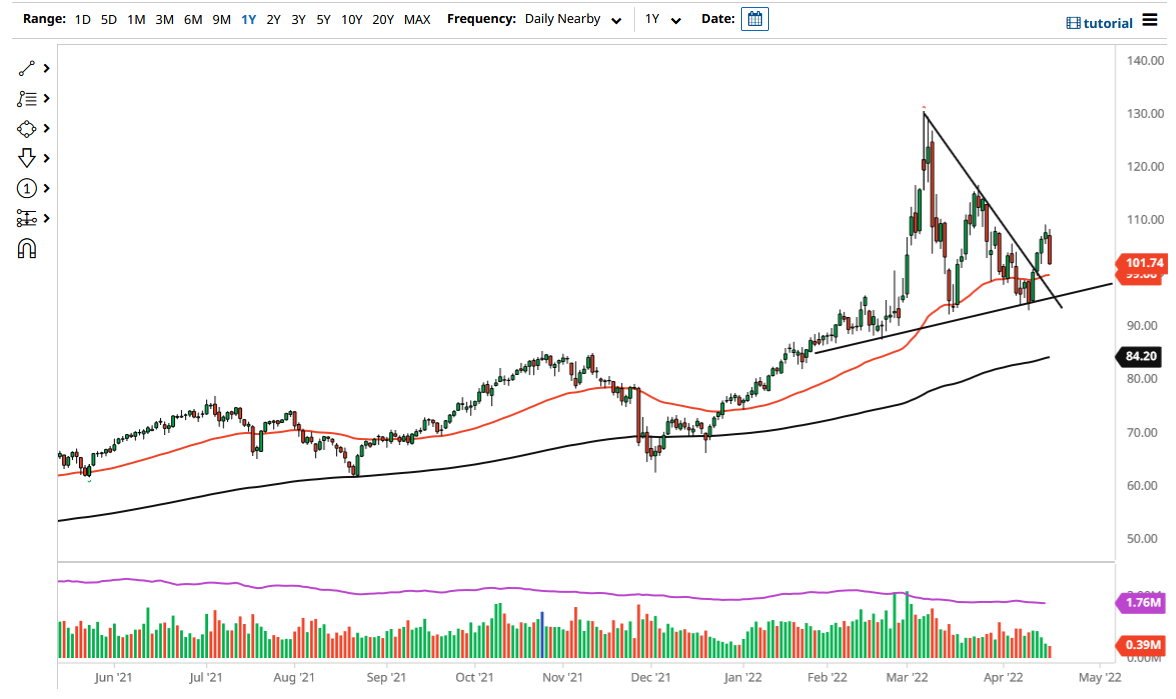

The West Texas Intermediate Crude Oil market fell rather hard during the trading session on Tuesday to reach the $102 level. This is a market that has plenty of support underneath though, so I am not necessarily looking to short this commodity anytime soon. The 50 Day EMA sits just below the $100 level, so that would be the next major support level for a bigger move.

The daily candlestick for the next 24 hours should be interesting, and if we did end up turning around to form a hammer, that would be an excellent buying opportunity from everything I see. Even if we were to break down below the $100 level and the 50 Day EMA, there is still an uptrend line that comes into the picture as well, so all things being equal, this is a market that I think has plenty of areas that buyers could be attracted to.

The size of the candlestick for the trading session on Tuesday does suggest that we have a little bit of follow-through coming, but that does not necessarily mean that the market is suddenly going to fall apart. Quite frankly, the bounce over the last week or so has been very strong, so I do think it makes quite a bit of sense that we would see follow-through to the upside eventually.

If we do break down below the uptrend line, then it is likely that the crude oil market could go racing to the $90 level, which is a large, round, psychologically significant figure, and an area that we have seen quite a bit of support at previously. In general, this is a market that I think will continue to be very noisy, and because of this, it is very likely that you should be cautious about the position size that you put on. After all, with all this type of volatility and confusion, it is likely that the market will continue to be noisy and difficult. Small positions that you build on when they work out in your favor will probably be the best way to attack this market, as headline risks are still out there, and of course, we have the first job of protecting our accounts, and therefore it is likely that the market could be a bit dangerous.