The pound sterling suffered a significant loss in its value against the euro, the dollar, and other major currencies last week. In the case of the GBP/USD currency pair, it fell to the 1.2275 support level, the lowest in two years, before closing trading stable around the 1.2335 level. Analysts say that more losses are possible this week, although a short rally cannot be ruled out.

Sterling’s exchange rates fell sharply in the wake of the British central bank’s decision to raise 25 basis points, but it warned that economic growth was likely to stall, and inflation would rise higher than initially expected. It was the bank’s latest set of forecasts, and the message in it that the market is expecting too many upsides, causing a lower recalibration of expectations, and the British Pound.

According to the performance of the forex market, the exchange rate of the pound to the euro fell by 1.44% last Thursday alone, and lost by 2.0% for the month of May. The pound-dollar exchange rate faces an even bigger loss of 4.30% for the month of May. “The narrative is very strong at the moment, and it’s hard to see much of a recovery in sterling,” JP Morgan’s FX desk told clients.

Overall, the GBP/USD currency pair on Friday halted the current bearish movement and instead is trading neutral after the latest round of US data. It now appears that the currency pair has found support at around 1.2332 after the US Labor Department brought back the US jobs data with mixed results.

Meanwhile, forex analysts at ABN AMRO say they also expect further weakness in the pound against the euro and dollar. Whereas, economists at ABN AMRO expect two more rate hikes from the bank in 2022, which is a bigger shortfall than the market still expects. These rallies are seen in June and August, but then expect the BoE to turn dovish, as the risk of recession begins to weigh more heavily in policy deliberations.

Accordingly, the bank’s analysts say: “Our new view is still more pessimistic than financial market prices. Therefore, we continue to expect further weakness in the pound.” ABN AMRO expects the exchange rate of the euro against the pound to be at 0.85 by the end of June, 0.85 by the end of September and 0.86 by the end of December. This gives an expectation of the Pound against the Euro at 1.1765 and 1.1630. Their point forecasts for the GBP/USD exchange rate are at 1.26 by the end of June, 1.24 by the end of September, and 1.22 by the end of the year.

Those readers hoping for a rebound in the Pound should note that near-term momentum remains firmly in motion against the currency, although some near-term relief rallies may form next week. But for now, there is a consensus among forex currency analysts that any strength is likely to be short-lived.

However, a more sustainable recovery could form once the market eliminates the excessive number of interest rate increases that the bank is anticipating.

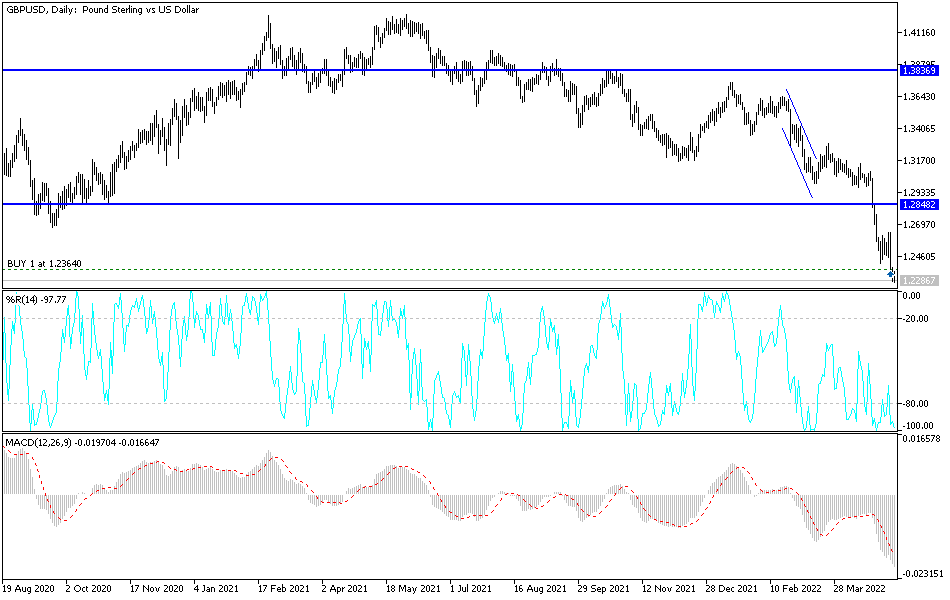

According to the technical analysis of the currency pair: In the near term and according to the performance of the hourly chart, it appears that the GBP/USD currency pair is trading within the formation of a descending channel. This indicates a short-term bearish slope in market sentiment. Therefore, the bears will look to maintain control of the currency pair by targeting profits at around 1.2245 or lower at 1.2150. On the other hand, the bulls will target potential bounces around 1.2435 or higher at 1.2526.

In the long term and according to the performance on the daily chart, it appears that the GBP/USD currency pair is trading within a descending channel formation. This indicates a significant long-term bearish momentum in the market sentiment. Therefore, the bears will look to ride the formation of the current trend towards support 1.2063 or lower to support 1.1689. On the other hand, the bulls will target long-term profits at around the 1.2622 resistance or higher at the 1.2996 resistance.