Despite the varying numbers of jobs and wages in the United States of America, the price of the currency pair USD/JPY jumped to the resistance level of 131.35. This is the highest for the currency pair in 20 years, before settling around the 130.30 level in the beginning of trading today, Tuesday. The recent economic figures did not move anything in the expectations of raising US interest rates strongly during the year 2022, which is the strongest factor for record gains for the US dollar against the rest of the other major currencies.

The US dollar gains this week on an important date with the announcement of US inflation figures. Some consensus metrics suggest that economists generally expect the more significant core inflation to accelerate from 0.2% to 0.4% m/m in the US during April in what may be an unhelpful outcome for those in the market.

The occurrence of a peak and subsequent decline in the annual rate of inflation in the US is critical if the US Federal Reserve is to be prevented from raising interest rates at the same pace that was ruled out at least temporarily in its monetary policy decision in May last week.

Overall, one month’s reading doesn’t tell us much. “We want to see evidence that inflation is moving in a direction that gives us more comfort,” Fed Chairman Jerome Powell said following last week’s policy decision. Like I’d say we have two months now where core inflation is a little lower, but we don’t see that as a reason to feel some relief. I think we really need to see that our expectations come true. He added in the last press conference that inflation is under control and has begun to decline.

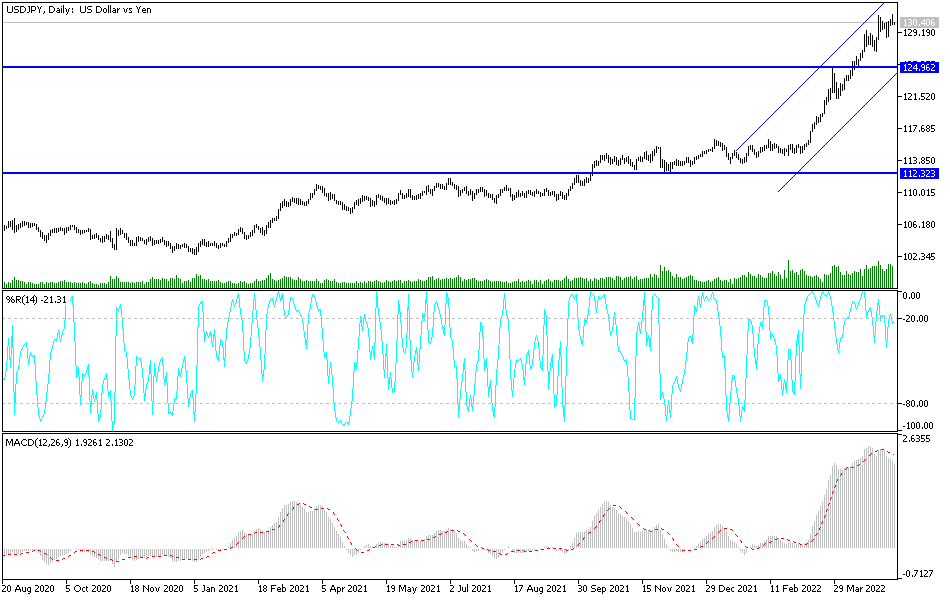

According to the technical analysis of the pair: There is no change in my technical view of the price performance of the USD/JPY currency pair, as the general trend is still bullish. The psychological top 130.00 is a culmination of the extent to which the bulls control the trend. Forex investors do not care about technical indicators reaching overbought levels after the pair’s recent gains. Continuing factors of the dollar’s strength, especially the future tightening of the US Federal Reserve’s policy, will remain an important factor for the bulls.

Currently, the best selling is waiting for profit taking operations from the resistance levels 131.30 and 132.20, respectively. On the other hand, it broke the support 128.00, a first penetration for the current upward trend. Amid the absence of the economic calendar today of important and influential US and Japanese data, investor sentiment, whether or not to risk appetite, will be an important factor for the currency pair’s movement.