As the performance of last week, the USD/JPY currency pair has been moving since the start of this week’s trading in a narrow range with an upward bias. It settled around the 129.50 level at the time of writing. It got close to breaching the 130.00 psychological resistance again, which supports the bulls’ dominance. So far, the US dollar is still the strongest with expectations of raising US interest rates throughout 2022. The results of the US economic data are still in favor of the policy of Jerome Powell and his team in aggressively raising interest rates until the US inflation is brought under control, which reached its highest level in 40 years.

US retail sales rose 0.9% in April, a strong increase that underscores Americans’ ability to continue increasing spending even as inflation remains at an almost 40-year high. For its part, the Ministry of Commerce said that the increase was driven by the increase in sales of cars, electronics, and restaurants. Even adjusting for inflation, which was 0.3% month over month in April, sales increased. Gas prices fell slightly last month, curbing inflation, after rising in March in the wake of the Russian invasion of Ukraine.

Consumers are providing crucial support to the economy even after a year of soaring gas, food, rent and other necessities. The US economy contracted in the first three months of the year, but consumer and business spending was still rising at a healthy pace. “Never bet the American consumer has always been a good saying,” Paul Ashworth, chief US economist at Capital Economics, a consultancy, said in a note to clients. “Despite the price hikes that are weighing on their purchasing power, it now appears that the American consumer is acting on their own to keep the global economy afloat.”

Tuesday’s report also showed that sales in March were revised much higher, to 1.4% from 0.7%. As a result, spending that month rose after adjusting for inflation, which rose to 1.2% as gas prices rose. The review notes that the economy has likely shrunk by less than the 1.4% reported last month. Strong employment, rapid wage increases, and a healthy level of savings have – on average – boosted consumers’ financial health, despite a sharp 8.3% increase in consumer prices in April from a year ago. The increase was just below the four-decade high reached in March.

Economists are still watching closely to see if consumer spending can continue to outpace inflation. As slow spending would hinder the growth of the economy. While that could lower inflation, it could also threaten to push the economy into recession.

For lower-income Americans, inflation takes a bigger toll and forces many people to adjust their spending patterns. However, the strong sales figures in the government’s report are also impressive given that retail sales cover only a third of consumer spending, with the rest going to services such as travel, haircuts, and healthcare. Airlines and hotels also posted strong sales as more people take trips after a two-year travel delay.

Overall, the continued strength of consumer demand, fueled by a strong labor market, is a major reason the Federal Reserve has accelerated its efforts to tighten credit and cool the economy. By doing so, Fed Chair Jerome Powell hopes to bring down inflation without causing a recession. Accordingly, the Federal Reserve raised its US short-term interest rate by half a point at its policy meeting earlier this month, double the usual increase. Powell also indicated that the Fed is likely to make the fastest rate hikes in 33 years to stem inflation.

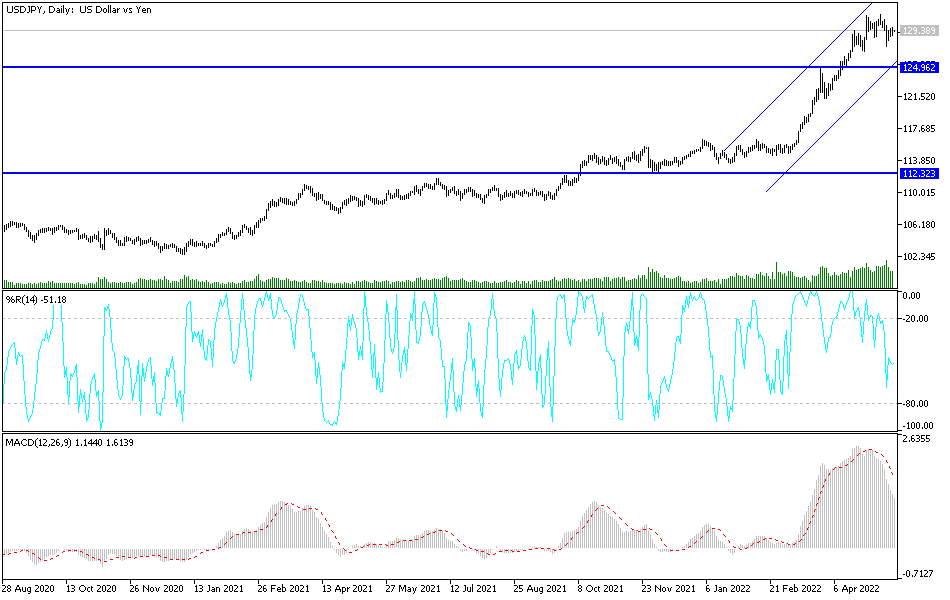

According to the technical analysis of the pair: There is no change in my technical view, as the breach of the 130.00 psychological resistance will be of special importance for the bulls to further control the performance of the USD/JPY currency pair, thus preparing to move towards stronger ascending levels. The policy of the US Central Bank, in addition to the extent of investors’ appetite for risk or not, will constitute the supporting factors for investors to move the price of the currency pair in one of the two directions. On the daily chart, the break of the support 126.80 will be important in changing the general trend to a bearish one.