For three trading sessions in a row, gold prices continued to rise with gains to the resistance level of 1865 dollars an ounce and settled around the level of 1853 dollars an ounce.

The recent gains moved the price to breach the descending channel, and the gains in the gold market coincided with the decline of the US dollar, moving further away from its two-decade high that it touched recently.

On the other hand, the increase in cases of the Corona virus in Beijing and fears of an economic slowdown increased the demand for the safe haven metal. The US dollar weakened against major currencies after US President Joe Biden said he was considering lowering tariffs on Chinese goods. Biden said, “I’m thinking about it. We do not charge any of those fees. It was imposed by the previous administration and is under study.”

Ongoing inflation concerns were weighing on the market and kept major indicators in the doldrums. The benchmark S&P 500 is emerging from its longest streak of weekly losses since the dotcom bubble was deflating in 2001. It is close to falling 20% from its peak earlier this year.

The effect of inflation on consumers and businesses has been the main concern for the markets, along with the Federal Reserve’s attempt to mitigate this effect by aggressively raising interest rates. Inflation was exacerbated by the massive disruption to supply and demand due to Russia’s invasion of Ukraine and its effect on energy prices. The supply chains have been hit the hardest by the recent shutdown by China of several major cities facing rising COVID-19 cases. Meanwhile, a string of disappointing earnings reports from major retailers last week raised concerns that consumers are cutting back on spending on a wide range of goods as they come under pressure from rising inflation.

Investors are concerned that the US central bank may go too far in raising US interest rates or move too quickly, which could hamper economic growth and potentially cause a recession. On Wednesday, investors will get a more detailed glimpse into the Federal Reserve’s decision-making process with the release of the minutes of the latest US Monetary Policy Setting Meeting.

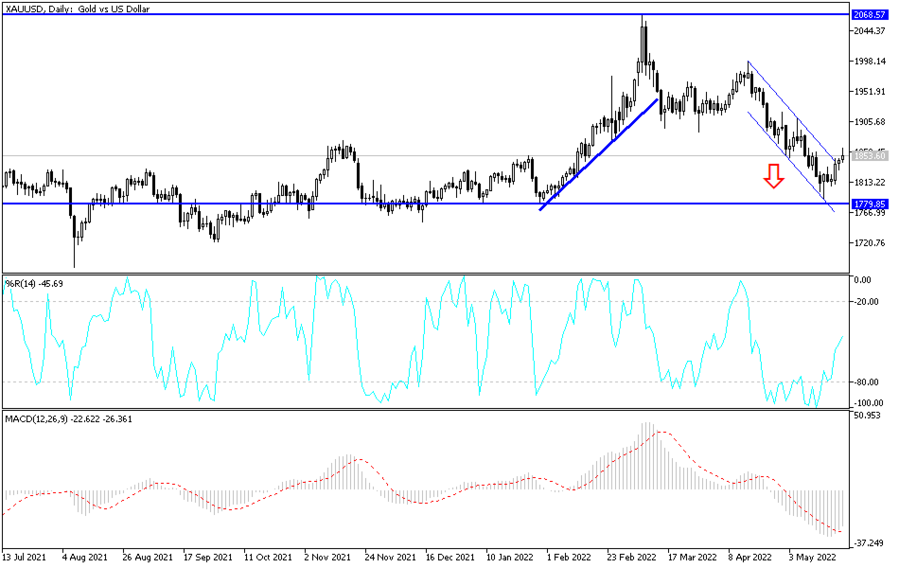

According to the technical analysis of the gold price: In the short term and according to the performance on the hourly chart, it appears that the price of gold is swinging within the formation of a gently ascending channel. This indicates a slight short-term bullish bias in market sentiment. Therefore, the bulls will target extended gains at around $1,854 or higher at $1,864 an ounce. On the other hand, the bears will look to make profits at around $1,835 or lower at $1,823 an ounce.

In the long term and according to the performance on the daily chart, it appears that the price of gold rebounded recently after completing the bearish XABCD reversal pattern. This indicates that the bulls are trying to control the price of gold. Therefore, they will look to extend the current retracement towards $1,885 an ounce or higher to $1,934. On the other hand, the bears will target long-term profits around $1813 an ounce or lower at the $1764 support level.