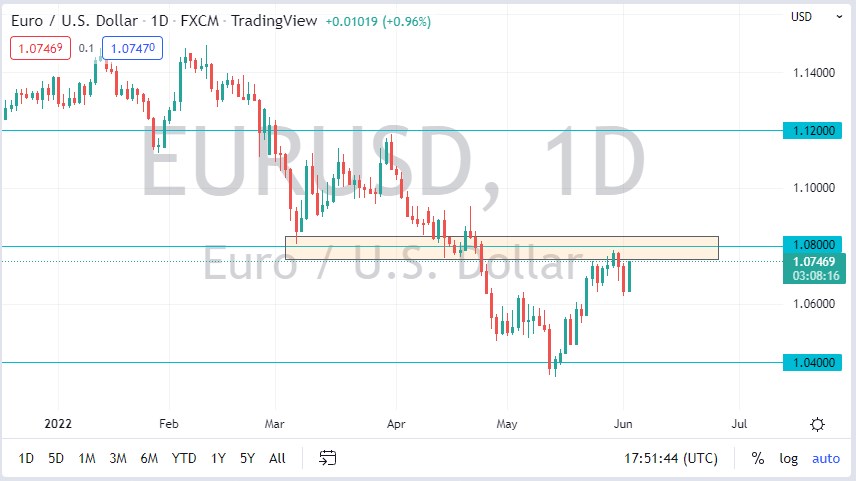

It is probably only a matter of time before we see sellers coming back into the market to take advantage of “cheap US dollars.”

The Euro recovered quite nicely during the Thursday session, to break to the resistance barrier yet again. At this point, the market is killing time between now and the jobs number, when we will get the next major catalyst. Whether or not we can continue to go higher is a completely different question, and there is a lot of resistance above that I think could cause some major problems. With this being the case, I think it is probably only a matter of time before the market sells off, but I am cognizant of the fact that if we break above the 1.09 level, we will have cleared several major hurdles.

On the downside, the 1.06 level is a potential target, followed by the 1.04 level, where we had bounced from previously. This is a very noisy chart, but then again, most charts are noisy at the moment as we try to figure out what to do next. I think at this point we are looking at a scenario where traders are going to have to decide where they are going longer-term. Recently, we’ve heard some jawboning out of the ECB that perhaps they may try to tighten monetary policy, but at the end of the day it will be somewhat meaningless in comparison to what the Federal Reserve might be able to do.

Once the jobs numbers out of the way on Friday, we should have quite a bit more clarity in the way that the market may view the US dollar, and therefore we will be able to trade this market with a bit more clarity. There’s not much that makes me want to buy the Euro, and I do recognize that it’s been very noisy. This has been a nice bounce, but when you look at the history of the currency pair, it is nothing out of the ordinary. While we happen falling right along, the Euro has bounced quite a bit over multiple recoveries. I think it is probably only a matter of time before we see sellers coming back into the market to take advantage of “cheap US dollars.” That being said, pay close attention to how the market closes on Friday, because it could give you a bit of a heads up as to where the US dollar may go over the next couple of weeks.