I think the next couple of weeks will be noisy, but I do think that it is only a matter of time before rallies get sold into.

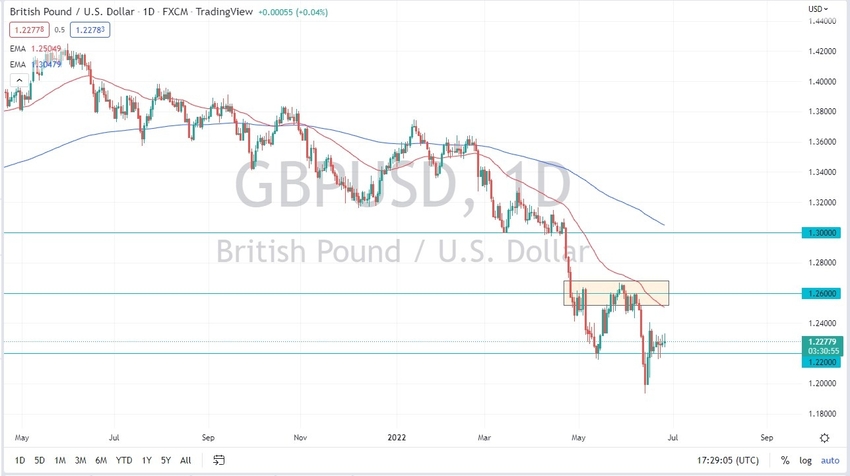

The British pound went back and forth on Monday as we continue to look a bit lost. At this point, the market had initially tried to rally but then gave back those gains that show indecision. The British pound has been difficult to trade over the last week or so, but it is worth noting that we are in a severe downturn. The 1.22 level underneath is a short-term support level, but if we were to break down below there, it opens up the possibility of a move down to the 1.20 handle.

If we do break above the highs of the last couple of days, it’s likely that the market could go looking to the 1.24 handle, possibly even the 50-day EMA above. After that, the British pound will have to deal with a 1.26 level as a major resistance barrier, something that I think will be very difficult to break above. If we did clear that, then it’s possible that we could see this market go to the 1.30 handle, but that would be an extreme move to the upside that would also have me thinking about the possibility of a change in trend.

The most likely scenario is that we break through those couple of hammers that are based around the 1.22 handle, as the US dollar is by far the strongest currency in the world right now, as people are trying to find some type of safety. At this point, the market is likely to continue to see a lot of concern out there, so it’s likely that the US dollar continues to be chased. Furthermore, interest rates in America continue to rise, so it makes quite a bit of sense that the greenback continues to be attractive.

If we were to break down below the 1.20 level, then the British pound could start to drift much lower, perhaps dropping to the 1.18 level. After that, the British pound could drop to the 1.15 handle, in what would be a rather significant move. I think the next couple of weeks will be noisy, but I do think that it is only a matter of time before rallies get sold into, and that’s exactly how I will be looking at this market, one in which I will be fading rallies that show the first signs of exhaustion.