Start the week of July 4, 2022 with our Forex forecast focusing on major currency pairs here.

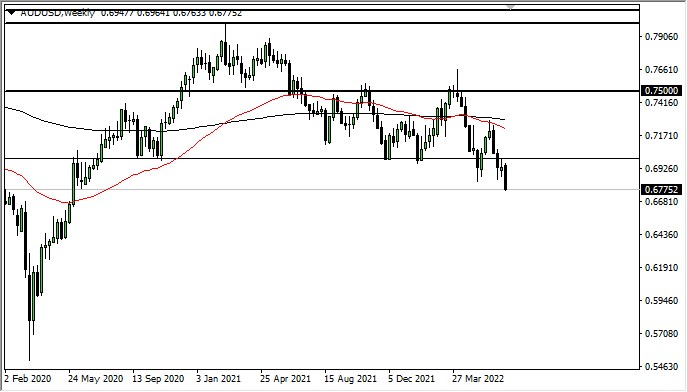

AUD/USD

The Australian dollar plunged last week as risk appetite has been decimated across the board. The Aussie is highly sensitive to commodities, so it does make sense that we would see the Australian dollar fall. That being said, it looks as if any rally at this point in time should be treated with suspicion, and I suspect that there will be plenty of sellers willing to get involved if the Aussie does try to recover a bit. The 0.70 level looks to be a bit of a “ceiling in the market” going forward.

EUR/USD

The euro initially tried to rally for the week but then broke down below the 1.05 level again. At the end of the week, it even managed to slice through the 1.04 level. If we break down below the lows of the last couple of weeks, it’s very likely that the euro will find itself trying to get down to the 1.02 level. By the end of the summer, I would anticipate that the euro could go to parity, which is my target. Rallies at this point in time continue to be selling opportunities unless of course we somehow break above the 1.08 level, something that I do not anticipate seeing any time soon.

GBP/USD

Much like the euro, the British pound was hammered last week, especially on Friday. The British pound currently sits at the 1.20 level as I write this article, and if we can break down below the hammer from two weeks ago, that opens up a move down to 1.18, followed by 1.16. The British pound is not necessarily a currency that I think is in trouble, it’s more or less all about the Federal Reserve and its proclivity to tighten monetary policy going forward. Quite frankly, I believe that this is a market that will continue to go lower but is probably best approached from a “fade the rallies” type of situation.

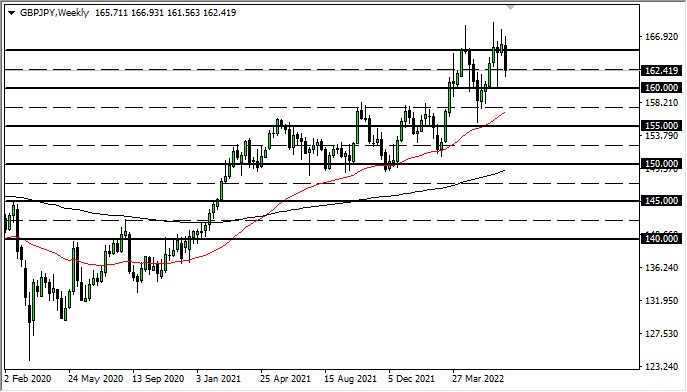

GBP/JPY

The British pound fell against the Japanese yen, but most of this was done on Friday. It is hovering around the ¥162.50 level, an area that has been supported in the past on the daily chart. Below there, we have the ¥160 level, an area that I think will be crucial for the longer-term health of this trend. Keep in mind this pair is highly sensitive to risk appetite, so that might have been the main reason for the pullback. On the other side of the equation, the Bank of Japan continues to flood the markets with yen.