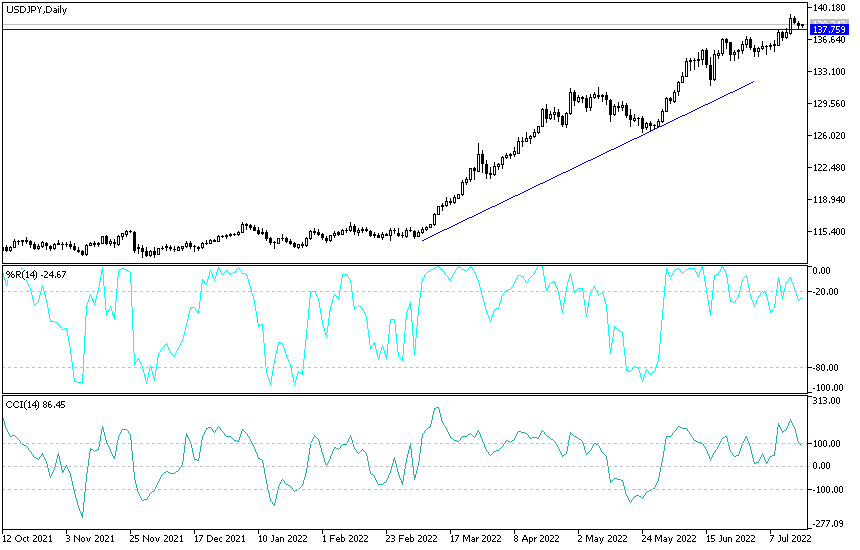

Despite recent profit taking sales, the USD/JPY currency pair is still in an upward direction. The bears moved towards the 137.88 support level at the beginning of this week’s trading, and the currency pair is settling around the 138.20 level at the time of writing the analysis. Last week the pair recorded the strongest for the currency pair in 24 years at 139.38

The yen is a popular asset during turbulent times.

The US dollar’s record gains in the Forex market were halted after calming comments from some US Federal Reserve policy officials about the future and amount of US interest rate hike. Friday’s June US retail sales figures suggested the US economy is a long way from the recession that many commentators recently suggested was likely to occur, while the University of Michigan’s gauge of US consumer confidence also saw a surprise rebound for July last week.

To the extent that sentiment towards the global economy improves and expectations regarding the Federal Reserve’s interest rate are kept secret in the coming weeks, the greenback may be at risk of further profit taking by investors and USD/JPY is likely to take further losses. over the coming days.

Randall Quarles, the former Federal Reserve’s deputy chair of supervision, said the Fed should have started raising US interest rates before it scaled back its bond purchases to avoid falling behind in the fight against inflation. Policy makers focused on resolving central bank asset purchases in a predictable way to avoid market turmoil, Quarles said during an interview with the Macro Musings podcast.

Fed officials generally prefer to stop buying assets – which are designed to add support to the economy – before raising interest rates, which remove support, to avoid sending mixed signals, he said. But officials should have made an exception and start raising interest rates last fall, once it became clear that inflation was widening and the labor market was shrinking.

“I think in these circumstances, and for a limited period of time, to say, ‘Yes, the balance sheet shrinkage should happen over a long period of time to avoid turbulence in the markets, but we will start raising US interest rates even before that tapering is complete,’” the official added. Because it was time to act more aggressively in response to inflation, “I think that would have been wise.” Fed watchers have criticized the central bank for being slow to respond to inflation, and policy makers have admitted that their expectations have missed the extent and breadth of price hikes. Officials began scaling back asset purchases in November and wrapped up the process in March – when they began raising interest rates – and gradually turned hawkish in the following months to curb rampant inflation.

The US central bank is now trying to catch up by raising interest rates and shrinking its balance sheet. Officials raised 75 basis points last month, the largest increase since 1994, and indicated they were likely to do the same again when they meet next week.

The general trend of the USD/JPY currency pair is still bullish, and the future of the historical resistance 140.00 is still possible as long as the currency pair is stable above the resistance 138.35; there will not be a first reversal of the current general bullish trend without breaching the 134.40 support level, according to the performance on the daily chart. Technical indicators are still directed to the upside.

Ready to trade our Forex daily analysis and predictions? Here are the best Forex brokers to choose from.