Despite the announcement of the US interest rate hike, as expected, the price of gold gained momentum and rose towards the resistance level of 1740 dollars an ounce. The US dollar declined following the comments of Federal Reserve Governor Jerome Powell following the decision. The price of gold is stable around the level of 1734 dollars per ounce at the time of writing the analysis. Speaking at a news conference after the Fed’s latest policy meeting, Bank Chairman Jerome Powell stressed that the US central bank remains committed to defeating chronically high inflation. Meanwhile, concern that the Fed’s efforts may eventually cause a growing recession as consumers and businesses suffer from higher prices and increased borrowing rates. Powell missed several opportunities to say the Fed would slow its gains if a recession occurred while inflation was still high.

But Powell also said that the pace of the Fed’s hikes may slow in the coming months now that the key interest rate has almost reached a level that is believed to neither support nor constrain growth. The suggestion helped spark a strong rally in Wall Street markets, with the S&P 500 stock market index up 2.6%. The prospect of lower interest rates in general is fueling stock market gains.

Meanwhile, Powell was careful during his press conference not to rule out another three-quarter point increase when Fed policymakers meet next September. He said that the interest rate decision will depend on what will emerge from the many economic reports that will be issued from time to time. “I don’t think the United States is in a recession,” Powell added at his press conference, noting that the Fed’s rate hike has already had some success in slowing the economy and possibly easing inflationary pressures.

Economic Outlook Today

The Commerce Department said US durable goods orders jumped 1.9% in June after rising 0.8% in May. The continued increase surprised economists who had expected durable goods orders to fall by 0.4%. Excluding a sharp rise in transportation equipment orders, durable goods orders rose 0.3% in June after a 0.5% increase in May. Economists had expected previous transfer orders to rise 0.2%.

Meanwhile, a separate report from the National Association of Realtors showed that pending home sales in the US fell sharply in June. NAR said its pending home sales index fell 8.6% to 91.0 in June after rising 0.4% to a revised 99.6 in May. Economists had expected pending home sales to decline 1.5% compared to the 0.7% increase originally recorded for the previous month.

Today’s XAU/USD Gold Price Forecast:

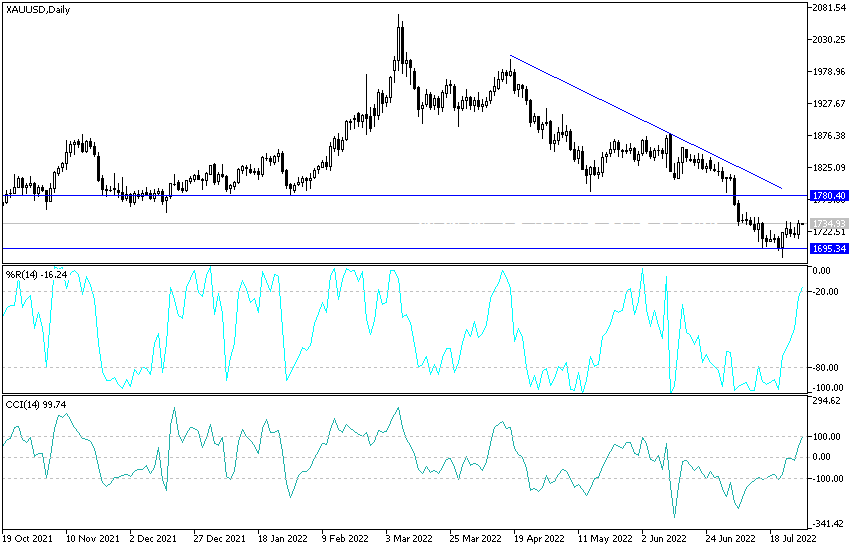

There is no doubt that the recent move in the price of gold after the announcement of the US interest rate hike is important for the bulls to control the direction of gold. The rise may be stronger if prices move towards the resistance levels of 1755 and 1778 dollars, respectively. As I mentioned before that the last level is important to move towards the level of psychological resistance 1800 dollars, which is of interest to change the general trend to the upside.

On the other hand, the return of the gold price to the vicinity of the support level of 1710 dollars for an ounce is important for the bears to control the trend further. The price of gold will be affected today by the announcement of the growth rate of the US economy.

Ready to trade today’s Gold forecast? Here are the best Gold brokers to choose from.