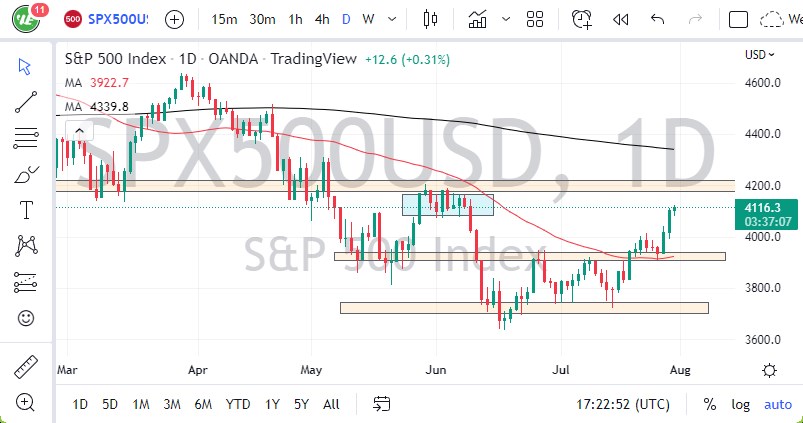

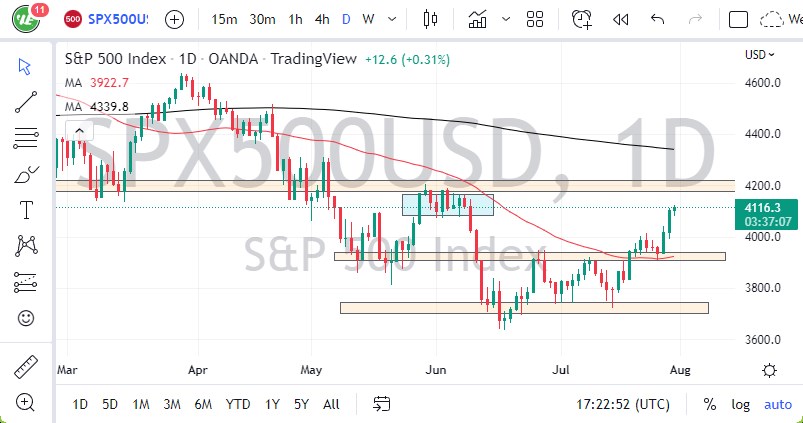

It’s interesting that we are lining up for a fight just as we are running into a bit of significant resistance.

- The S&P 500 Index initially pulled back Friday but then turned around to show signs of bullish pressure late in the day.

- It does make sense that the market rallied on Friday, mainly due to the fact that money managers will try to mark up into the end of the month.

- This is a market that has a little further to go before it hits massive resistance, but it is worth noting that the market has been relentless.

Eyeing the 4200 Level

I do believe that we will out of momentum sooner or later, with the 4200 level above being important. It’s worth noting that the area has been resistant before, so if we get some type of exhaustion candlestick in the general vicinity, I am willing to start shorting. This makes sense, due to the fact that even though interest rates have dropped in the United States, the reality is that the Federal Reserve has not suggested that it was ready to pivot. True, they said something about being near the neutral rate, but they also suggested that there are still hikes coming.

If we do break above the 4200 level, then it’s possible that the market could go looking to the 200-day EMA. That obviously would be a very bullish turn of events, and at that point, I think the market would have just about proven its uptrend. This has been a market that has been overdone on multiple time frames. Because of this, I think at the very least we can probably count on some type of pullback, but the fundamental information out there that we have right now does not suggest that we are ready to take up to the upside.

The 4000 level underneath would probably be important as well, as it is a large, round, psychologically significant figure. After that, then we have the 3950 level which would be rather important as well. The market is most clearly bullish in the short term, and momentum is most certainly on the side of the buyers. However, it’s interesting that we are lining up for a fight just as we are running into a bit of significant resistance. Whether or not we can continue this move is a completely different question, but I do think Monday is going to be interesting to say the least.

Ready to trade our S&P 500 daily forecast? Here are the best CFD brokers to choose from.