The EUR/USD dropped significantly last week before entering a circle of parity but rose smartly in time to close out the week and can now defy gravity by trading solidly above a temporary low around the 1.0020 level in the coming days. The price of the EUR/USD fell to the 1.0032 support level, the lowest since 2002. The US dollar is stronger with the expectations of raising interest rates and the demand for it as a safe haven in light of the increasing expectations of a global economic recession. The Eurozone may be the first for this to happen.

The EUR price approached the psychologically important milestone which is parity with the Dollar on Friday but ended the last session of the week higher after rallying after making contact with another noteworthy technical level. As Lee Hardman, FX Analyst at MUFG warns, “It now seems only a matter of time before the EUR/USD pair drops below parity. And that the main driver of euro weakness continues to raise concerns about further disruption to European economies from tightening energy supplies.” “In these circumstances, we expect the euro’s downtrend to remain in place,” he added. Euro weakness may accelerate even when EUR/USD breaks below parity and opens the door for EUR/USD to trade between 0.9500 and 1.0000 levels.”

EURUSD traded as low as 1.0070 last week, a level that closely coincides with the 78.6% Fibonacci extension of last Tuesday’s massive pullback, and seems to have triggered an immediate supply from the market that may be noteworthy for other reasons as well. The same 78.6% Fibonacci extension closely coincides with the 100% extrapolation of the downtrend from January 2021 to November 2021 while Friday’s rally left behind on the charts what could be something like a “doji” or “hammer” candlestick reversal pattern.

To the extent any of the above indicates that a temporary bottom has been hit, the single European currency will be on track to stabilize without any further collapse below par in the coming days, although analysts are still generally bearish in Euro forecast.

“The euro against the dollar is dangerously close to parity,” says Mazen Issa, senior FX analyst at TD Securities. And while we expect to offer some natural defense (particularly in the area of options), the overall headwinds are massive in Europe and the balance of payments suffers an epic deterioration that is likely to continue. Without the euro offset, the dollar remains king.” “Every data point will be subject to a great deal of scrutiny and will continue to clamp down on market speculators,” the analyst added. We will admit that the shock value of the data and even the tightening has certainly declined, but we are cautious about holding risk-positive positions in the upcoming inflation and upcoming CIE releases, both of which are likely to be fairly strong.”

This week’s economic calendar has no major data for the euro but market appetite for it and the dollar is likely to be sensitive to the results and repercussions of US inflation data for June on Wednesday as well as a host of other US economic numbers. And while the market remains bearish on the EUR, it may be appropriate that the dollar didn’t make much of the short rally that followed on Friday when the US Non-Farm Payrolls report for June came out much stronger than expected.

It also made slight progress when the Institute for Supply Management (ISM) Services last Wednesday added to several recent indications that recession fears in the United States may have already reached a peak. Meanwhile, the dollar has not been able to hold out for long in any period of time, the erratic force that still characterizes its advance against many currencies.

EUR/USD Forecast

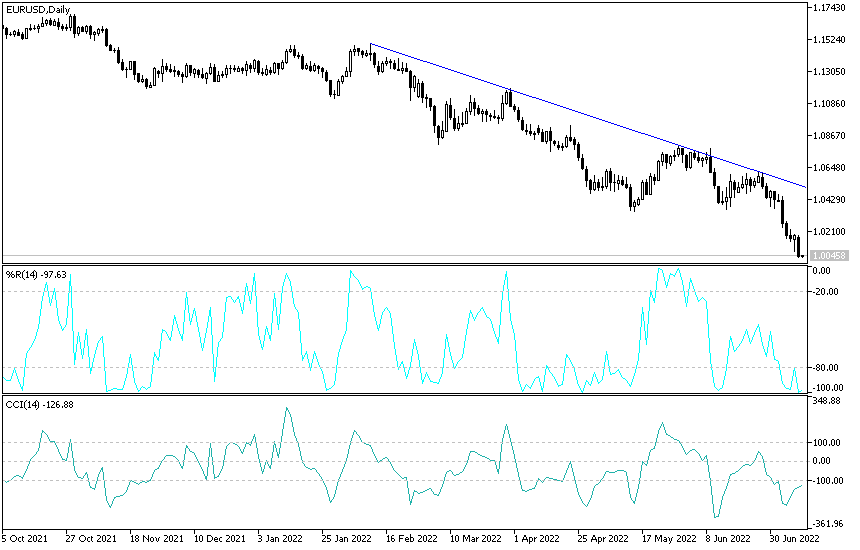

On the daily chart, the downward trajectory of the EUR/USD price is still continuing, and the reason for the decline of the euro is the future tightening central bank policy and fears of an inevitable economic stagnation in the eurozone due to the continuation of the Russian-Ukrainian war and the renewed outbreak of the epidemic from China. The price of the EUR/USD is the closest to testing the parity price 1.0000, after which the collapse will continue technically, despite the arrival of all technical indicators towards strong oversold levels.

With the continuation of the weakness factors, the attempts of the pair to rebound to the top will remain a target for selling. Currently, the nearest resistance levels for the euro are at 1.0135 and 1.0225, respectively. The Euro will be affected today by the announcement of the German ZEW reading.