I think that what we saw on Friday has been more or less profit-taking more than anything else.

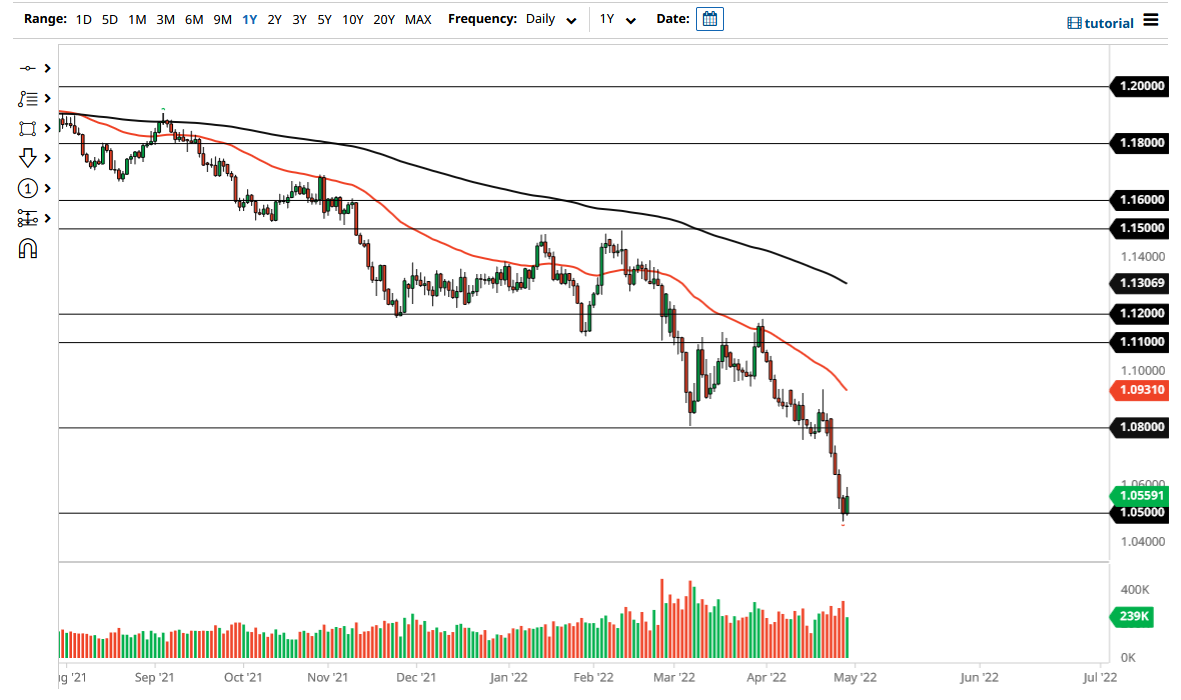

Euro trading was rather negative over the last couple of weeks but turned around on Friday to show signs of life at the 1.05 level. The 1.05 level is a large, round, psychologically significant figure, and I think a lot of people will have to wait to see whether or not we get signs of exhaustion that we can take advantage of. It was a rather bullish move, but in the big scheme of things, it is pretty minor.

The 50-day EMA is sitting just above the 1.09 level and is starting to break down from there. It is possible that the market could go looking to the 1.08 level underneath, which is an area that had previously been supportive. Furthermore, if we do a rally at this point for any type of significant move, the 1.08 level should be a major resistance barrier, as it is essentially a “ceiling in the market.”

Keep in mind that the European Central Bank is very loose with its monetary policy, and cannot do anything too drastic, as although there is inflation in the European Union, the reality is growth is threatened at the moment. Not only is growth threatened, but it could get worse as there are a lot of concerns when it comes to energy.

If we were to break down to a fresh, new low, the market then more than likely will eventually try to get down to the parity level. However, you need to think that the area could be supportive, simply because there have been multiple attempts to break down below it, but it has held more than once. We slammed into this area rather quickly, so more likely than not we will not have the necessary momentum to continue going lower.

It is not until we break above the shooting star from last week that tested the 1.0933 level that I would be a buyer. The other thing could be if we see the Federal Reserve start to look a little bit more dovish, but that is not going to happen in the short term, because they are in the “blackout period” ahead of the next meeting. Because of this, I think that what we saw on Friday has been more or less profit-taking more than anything else.