The market continues to see a lot of indecision.

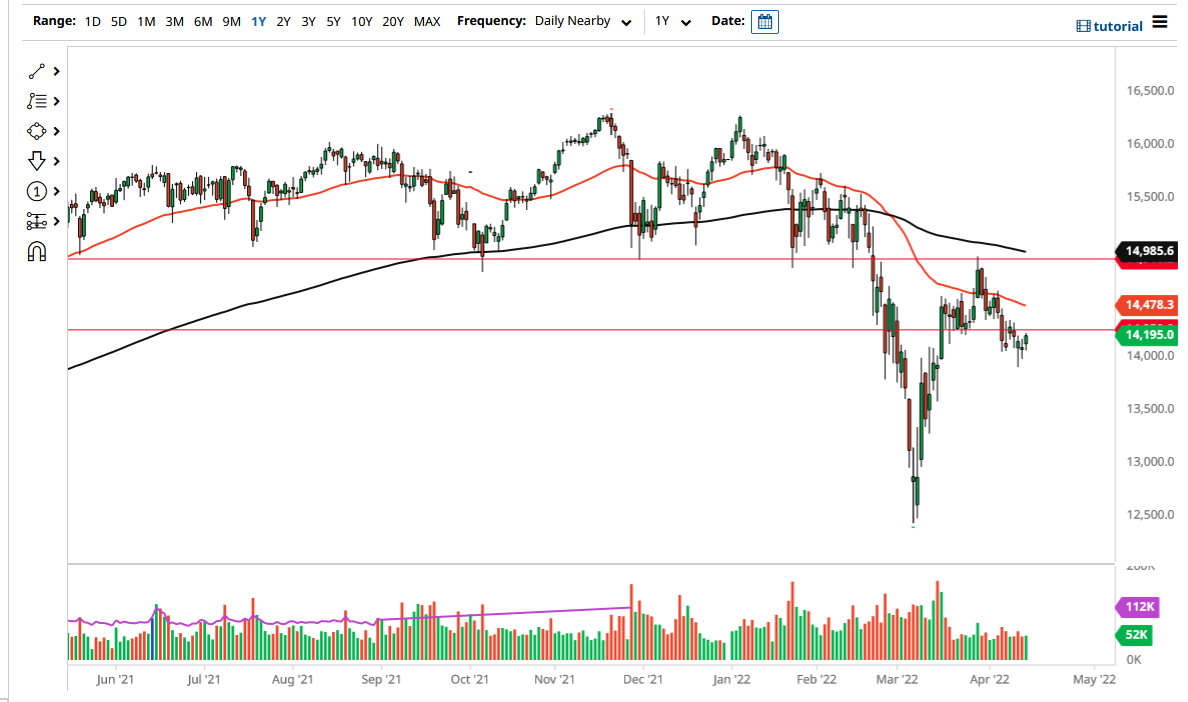

The DAX has initially pulled back just a bit during the trading session after gapping higher, filling the gap, and then turning right back around. Ultimately, this is a market that looks as if it will test the €14,250 level. Ultimately, if we can break above that little consolidation area, then the market is likely to go looking to the 50 Day EMA above, which of course will attract a certain amount of attention as well. We are in a downtrend, and any rally at this point in time is likely that signs of exhaustion will be jumped upon.

If we were to turn around a breakdown below the hammer from the Thursday session of last week, then it is likely we could go looking to the €13,500 level, perhaps even down to the €13,000 level. I think the DAX is a market that is going to continue to see trouble, and as a result, I think this bounce is more likely than not going to be looked at with a certain amount of suspicion. The 50 Day EMA being broken to the upside could open up a move to the €14,900 level, essentially where the 200 Day EMA is sitting in the same general vicinity.

The market will continue to see a lot of volatility, but ultimately, I think we are getting closer to a definitive decision. If you believe in the idea of a falling wedge being an opportunity, then a break higher could lead to that €14,900 level. On the downside, if we do break down below the massive hammer from last Thursday, I anticipate that the momentum will start to pick up as it will be obvious to most traders out there that things are starting to fall apart again.

Keep in mind that the DAX is highly sensitive to risk appetite in the futures market and of course everything that is going on in the European Union. The energy issue in Germany is going to continue to be a major issue going forward, so you have to pay close attention to those noisy headlines as well. At this point, I think this is a market that continues to be noisy, so pay close attention to signs of exhaustion if and when they occur. The market continues to see a lot of indecision.