This week, it will be unusual in the reaction to the price of the GBP/USD currency pair, as the currency pair will await the announcement of interest decisions from both the Bank of England and the US Federal Reserve.

The sharper tone towards more rate hikes will benefit one of the currencies. Amid the recent strength of the US dollar with expectations of raising US interest rates, the sterling dollar currency pair fell towards the 1.2411 support level, its lowest since July 2020, and it may start trading this important week, stable around the 1.2580 level.

At the end of last week’s trading, the currency pair tried to rise as the British pound is looking to recoup some of this week’s losses of 2.5 percent against the rise of the US dollar. All in all, the US dollar had a particularly strong month and yielded good returns for traders who were betting on one of the strongest trends in the global financial markets.

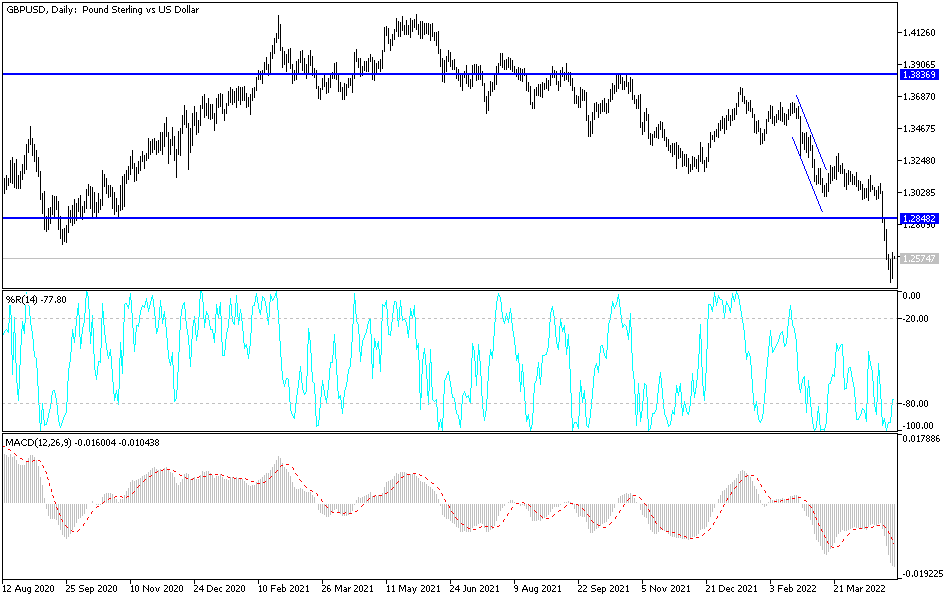

There are no headlines or key terms to explain the dollar’s decline ahead of the weekend, but purely technically it was bound to happen at some point: the GBP/USD and other dollar pairs are in oversold territory now. A look at the daily chart of the GBP/USD pair shows that the Relative Strength Index (RSI) has dropped significantly below the oversold water mark at 30. This does not represent a trend reversal. The Relative Strength Index (RSI), an indicator that can give clues to the momentum of a financial market while also indicating when the market is oversold or overbought. Anything less than 30 is oversold, and the above shows that the GBP-Dollar did not reach such oversold conditions during 2022. When it was last oversold in March, there was a further rally, but it did not represent a turn in trend .

The last time sterling reached more oversold states was back in 2020 when markets were in complete panic regarding the spread of the Covid-19 virus. A correction in the RSI will be inevitable: this could mean a higher recovery or simply a pause in the downward movement and some of the following days of bearish movement.

This does not necessarily mark the end of a downtrend that has been in place for nearly a year now.

JP Morgan’s forex analysts this week lowered their forecast for the pound-dollar exchange rate, largely as an admission that the dollar’s continued rally should continue further. “The system of weak growth expectations and high inflation has persisted and continues to support the strength of the US dollar,” says Mira Chandan, FX strategist at JP Morgan.

As a result, the investment bank raised its dollar forecast by an average of 1.5% over its forecast horizon. JP Morgan’s outlook for a strong dollar is dependent on the exceptional economic performance of the United States relative to the rest of the world, and the associated responsive rise in interest rates at the US Federal Reserve. Accordingly, Chandan says, “The backdrop for global growth and inflation remains fragile and supports the strength of the dollar.”

Chandan notes that global growth forecasts have been lowered in the past six weeks and inflation expectations have increased. “We are making major revisions to the outlook for the major US dollar pairs this month,” the analyst adds. This includes: EUR/USD As forecasts for the third quarter of 2022 have been lowered to 1.05 from 1.11 and the 2023 quarter has been reduced to 1.10 from 1.13. The bank’s forecast for GBP/USD for the third quarter of 2022 was lowered to 1.27 from 1.33 and the first quarter of 2023 fell to 1.31 from 1.34 previously.

Accordingly, analysts say the downgrade to Euro and Pound forecasts partly reflects the growing evidence of stagflation in the Eurozone and UK economies.

According to the pair’s technical analysis: GBP/USD may finally be ready to reverse its slide, as the price finds support at the 1.2400 area. The correction may lead to a rise in the Fibonacci retracement levels or the previous triangle support around 1.3000. The 38.2% Fibonacci level at 1.2680, then the 50% level at 1.2764. The biggest retracement could be 61.8% Fibonacci near the minor psychological mark of 1.2850 or the bottom of the broken triangle near the dynamic reversal points of the moving averages.

The 100 SMA is below the 200 SMA to indicate that the general trend is still down, and the selling is more likely to resume than reverse. The gap between the indicators is slowly widening to reflect increased selling pressure. Stochastic is rising above from an oversold area to indicate that buyers are taking over while tired sellers are taking a breather. Likewise, the RSI is moving upwards, so the price can follow suit as upward pressure increases and be able to enjoy both Oscillators with plenty of room to go up before reversing overbought conditions.