I have often recommended selling the GBP/USD pair from every bullish level and last week’s trading moves confirmed the strength of what we mentioned. The GBP/USD pair recovered towards the 1.2293 resistance level, the highest for the currency pair in more than a month, from which the pair rebounded strongly to the vicinity of the 1.2003 support. This was after the announcement of stronger than expected numbers of US jobs, which in turn supports the path of raising US interest rates strongly throughout the coming months. The GBP/USD pair closed the week’s trading around the 1.2073 level, but the bears’ control might move it towards stronger support levels.

GBP/USD Fundamental Analysis:

The GBP/USD is trading affected by the results of the important economic data recently, as the US jobs data for the month of July came in stronger than expected with 528 new jobs recorded against the market expectations of 250K. Moreover, the country’s unemployment rate fell to 3.5% from 3.6% in June, also exceeding the consensus forecast of 3.6%. On the other hand, average hourly wages rose 5.2% year over year, topping the average estimate of 4.9%. The equivalent (monthly) also outperformed 0.3% by 0.5%.

From the UK, the Bank of England raised its policy rate by 50 basis points to 1.75%, in line with expectations. Prior to that, the British S&P Global/CIPS PMI for July fell from expectations at 52.8 with a reading of 52.1, while the services PMI came in below expectations of 53.3 with a reading of 52.6.

Sterling dollar technical analysis:

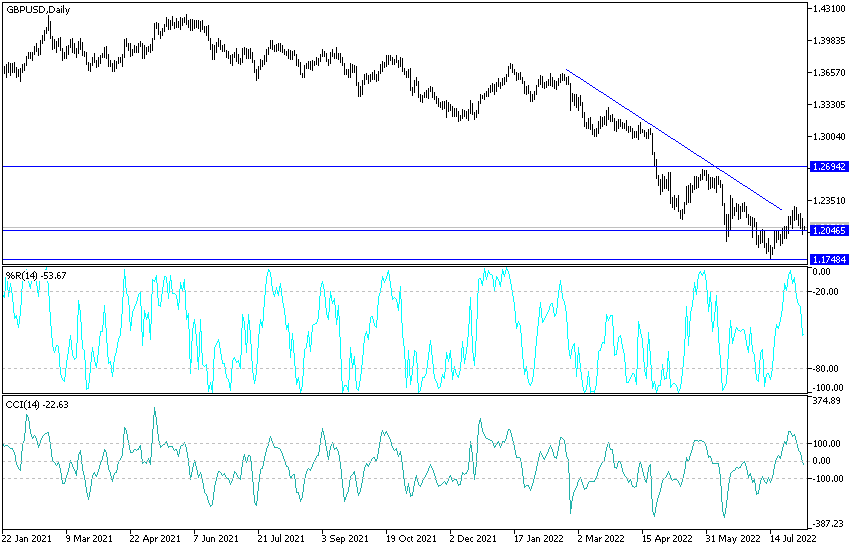

In the near term and according to the hourly chart, it appears that the GBP/USD is trading within a descending channel formation. This indicates a significant short-term bearish momentum in market sentiment. Therefore, the bears will look to extend the current declines towards 1.2022 or lower to 1.1964. On the other hand, the bulls will target short-term retracement profits around 1.2122 or higher at 1.2184.

In the long term and according to the performance on the daily chart, it appears that the GBP/USD is trading within a sharp descending channel formation. This indicates a strong long-term bearish momentum in the market sentiment. Therefore, the bears will look to maintain control of the currency pair by targeting profits at around 1.1924 or lower at 1.1766. On the other hand, the bulls will look to pounce on profits at around 1.2235 or higher at 1.2387.

Ready to trade our daily Forex forecast? Here’s a list of some of the best Forex brokers to check out.