Throughout this week’s trading, bulls’ attempts to push the price of an ounce of gold to the top failed, as gold gains did not exceed the resistance level of $ 1841 an ounce.

With the return of the strength of the US dollar and the start of stimulus to the yellow metal market, the price of gold XAU/USD returned to decline to the support level of $ 1812 an ounce. This is its lowest for the past two weeks and settles around the level of $ 1818 an ounce. Gold prices fell as the dollar rose amid rising inflation and fears about the risks of an economic recession, which led to a surge in demand for the currency’s safe haven.

Comments from Fed officials confirming further sharp increases in US interest rates to cut high inflation also boosted the dollar. In this regard, the President of the Federal Reserve Bank of San Francisco, Mary Daly, said this week that the annual economic growth of the United States is expected to slow to less than 2 percent amid tightening monetary policy by the central bank.

At the Joint Policy Committee with leaders of the European Central Bank and Bank of England, Federal Reserve Chairman Jerome Powell reiterated the FOMC’s commitment to lower inflation. He added that while the Fed does not target the foreign exchange rate, the dollar’s strength is working to reduce inflation at the margins.

On the US economic news front, revised data from the Commerce Department showed that US economic activity contracted slightly more than previously estimated in the first quarter of 2022. The report showed that the decline in real GDP in the first quarter was revised to 1.6% from 1.5% previously announced. Economists had expected the drop in GDP to be unrevised.

The slightly larger drop in GDP in the first quarter followed the 6.9% rise in GDP in the fourth quarter of 2021.

Prior to that, a report from the Conference Board showed that consumer confidence in the US continued to deteriorate in June. The statement said that the US consumer confidence index fell to 98.7 in June from a downwardly revised 103.2 in May. Economists had expected the index to decline to 101.0 from originally 106.4 for the previous month. As the decline continued, the US consumer confidence index fell to its lowest level since it reached 95.2 in February 2021.

The US stock market struggled to find direction on Wednesday, as traders evaluated central bank chiefs’ comments on the outlook for the economy and interest rates. As such, the S&P 500 closed almost flat and above the 38.2 percent Fibonacci retracement level of around 3,815 that investors were watching closely. The quarterly rebalancing of portfolios has contributed to market volatility. So, I won the bonds and the dollar.

Volatility has gripped the markets this year due to concern that a hawkish Fed could push the economy into recession. The S&P 500 is on its way to its worst quarter since March 2020 amid a surge in Treasury yields. The US central bank was in denial about inflation and moved very slowly in an attempt to calm rising prices. That has put it on a path to a recession if it hasn’t already.

The bond market turned around with a half-point cut in the Fed’s benchmark interest rate sometime in 2023, as traders raised their bets on a US recession that eventually halted the central bank’s violent tightening campaign. In this regard, Loretta Meester, president of the Federal Reserve Bank of Cleveland, said that officials should not be satisfied with increases in long-term inflation expectations and should act aggressively to reduce price pressures. Wednesday’s data showed US consumer spending expanded in the first quarter at the weakest pace of the pandemic recovery, pointing to a sudden sharp downward revision indicating that the economy is on weaker fundamentals than previously thought.

CFOs are growing increasingly pessimistic about the economy this year, with the sentiment gauge dropping to its lowest level in nearly a decade. Participants have lowered their growth expectations, according to the latest quarterly results of the CFO’s Survey, a collaboration between Duke University’s Fuqua School of Business and Fed Banks in Richmond and Atlanta.

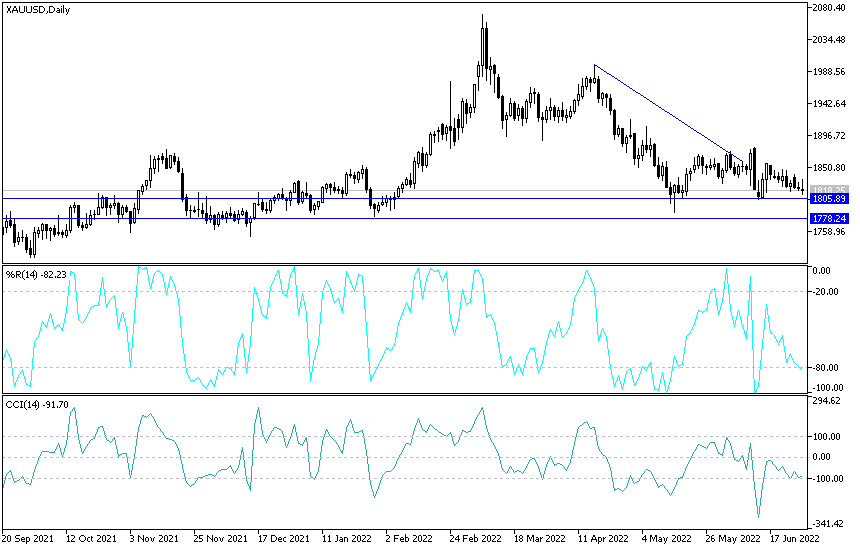

Gold price analysis today:

The downside trend for the XAU/USD gold price may increase in the event that prices move towards the psychological support level of 1800 dollars an ounce. This may increase the technical selling to move towards stronger support levels, and the next for the bears will be the targets of the support levels 1785 and 1770 dollars, respectively. I still prefer buying gold from every bearish level. On the upside, the bulls may find strong momentum if prices move higher towards the resistance levels of 1838 and 1855 dollars, respectively.