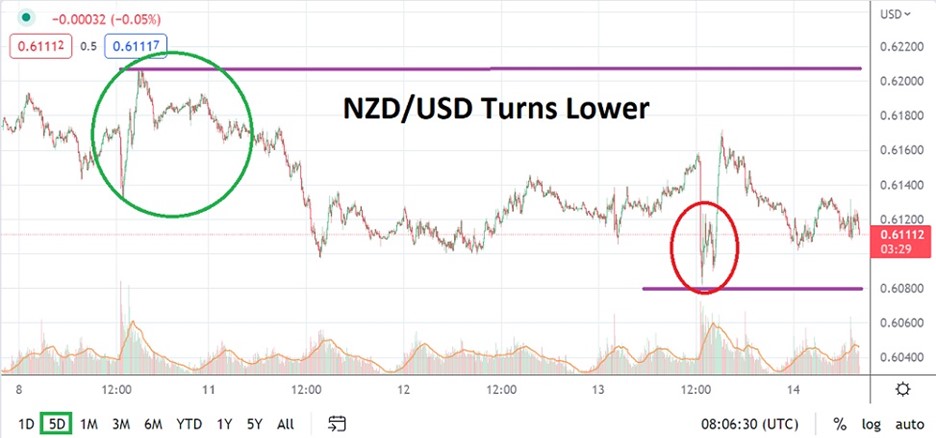

The NZD/USD made new long-term lows yesterday, and the currency pair is challenging values not seen since May of 2020.

The NZD/USD is hovering over the 0.61000 with a rather strong bearish trend seemingly in complete control. Certainly, speculators could try to wager on sudden upside moves developing with the NZD/USD currency pair, based on the notion that reversals are a natural part of the trading landscape. However, from a risk reward perspective near term, there appears to be a serious amount of technical data which highlights the larger moves for the time being still may occur to the downside.

Yesterday’s Lows Highlight the Bearish Trend Remains Durable and is Not Fading

Yesterday’s lows in the NZD/USD saw the currency pair approach the 0.60830 mark, this happened as U.S inflation data caused a surge in market conditions and selling action ensued. The NZD/USD provides speculators with volatile trading landscape under normal conditions, and the current economic environment is not normal. U.S interest rates and the notion additional hikes will come from the U.S Federal Reserve are clearly having an effect with the USD/NZD.

- A fall below the 0.61000 level that is sustained would be an additional strong bearish signal.

- Volatility will likely increase as new U.S economic data is published today and tomorrow.

The steady bearish trend will likely reverse with a strong amount of movement one day, but picking when this is going to happen remains difficult. The often heard quote from speculators that the ‘trend is your friend’ is not wrong. Risk taking tactics with the NZD/USD should be used, blind short selling is not recommended. However, wagering on further downside price action could prove to be worthwhile. Conservative traders may want to wait for perceived resistance levels to come into view and then igniting selling positions.

The 0.61000 level for the NZD/USD is an Important Inflection Consideration for Speculators

If the NZD/USD breaks below the 0.61000 mark near term and begins to show an inability to climb back above this mark, this would be an additional negative indicator. The 0.60900 is another key level for traders looking for lower depths technically. Yesterday’s trading certainly went below this value, but the spike higher was rapid. If the NZD/USD maintains value below the 0.60900 this could raise suspicions lower depths will be touched and be maintained.

It is likely consolidated trading will be seen in the NZD.USD currency pair in the short term. While technical barriers are important for the NZD/USD, so is the coming economic data which will be published in the U.S via PPI inflation results today and tomorrow’s Retail Sales. The economic insights from the U.S will have a direct impact on the U.S Federal Reserve, and financial institutions are sure to gear up their trading over the next two days, which will lead to additional volatility.

NZD/USD Short-Term Outlook

Current Resistance: 0.61370

Current Support: 0.60891

High Target: 0.61793

Low Target: 0.60510

Ready to trade our daily Forex analysis? We’ve made a list of the best brokers to trade Forex worth using.