The financial markets are a bit of a mess these days, and gold will reflect that right along with everything else.

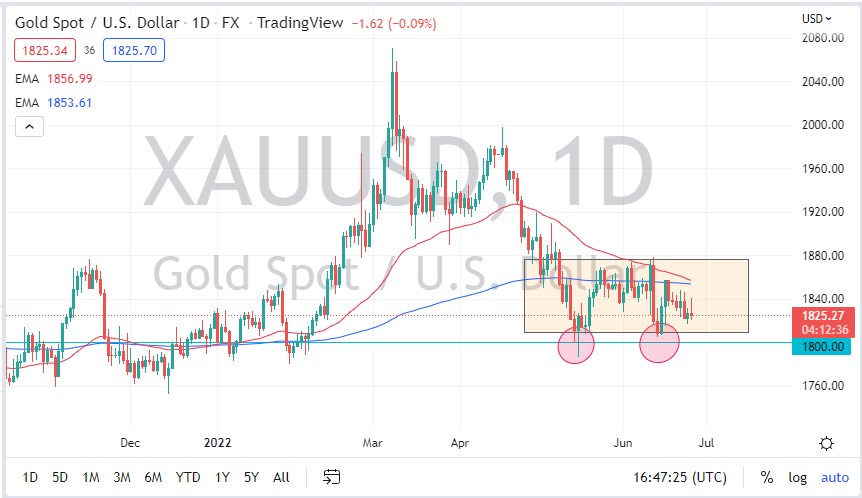

Gold markets initially tried to rally on Monday but gave back gains to show signs of weakness yet again. Ultimately, the market is likely to continue to see a lot of volatility and negativity. The gold markets giving up gains near the $1840 level suggests that we could go to the bottom of the overall consolidation area, which is at the $1800 level.

The 200-day EMA is sitting just above the $1850 level and going sideways. That suggests that the market is currently looking for some type of bottom, and the $1800 level could be a huge area. The $1800 level is not only a large, round, psychologically important number, but it is also an area that has seen action in the past, so I do think that it is crucial. If we were to break down below the $1800 level, it’s likely that we go down to the $1750 level rather quickly.

If we were to break above the $1850 level, it’s likely that we could go to the $1880 level. The $1880 level is an area that has been resistant more than once, so I do think that it is probably going to be crucial if we do break above there and will more likely than not send the market much higher. At that point, the market is likely to see an attempt to get back to the $2000 level, which obviously would attract a lot of attention, which could bring in more money.

The interest rates in the United States will continue to have a major influence on where the gold market will go next. Ultimately, I think the only thing you can count on here is a lot of volatility, and that being said, the market is going to see swings in both directions, so you need to be very cautious with your position size, and perhaps focus on short-term charts more than anything else. After all, the financial markets are a bit of a mess these days, and gold will reflect that right along with everything else. The US dollar has a negative influence on the gold markets as well, so pay attention to the US Dollar Index. The candlestick for the day suggests more weakness than strength, so you should probably keep that in mind.