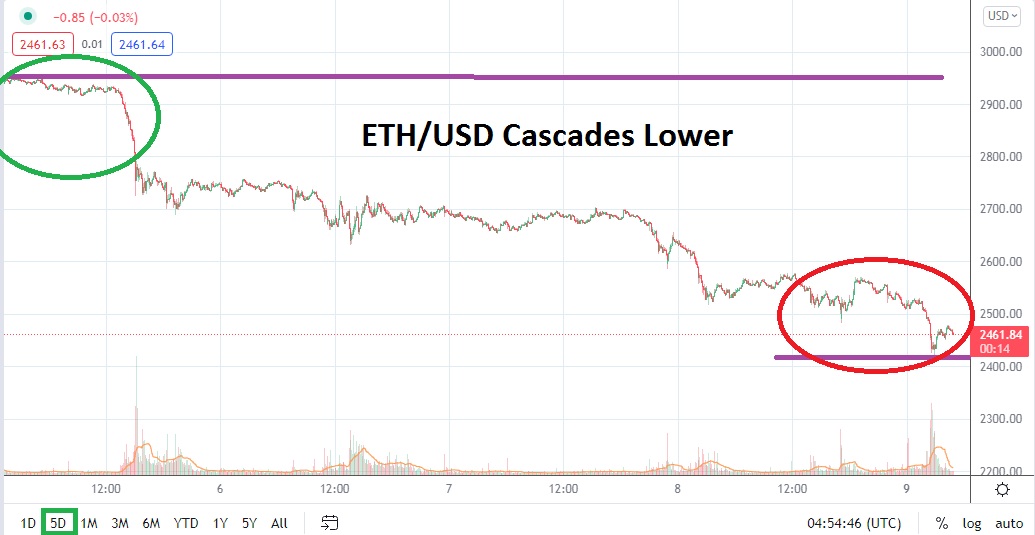

ETH/USD suffered another weekend of strong selling, and its price has shown signs of rapid lower moves as values have broken through key levels.

ETH/USD is trading near the 2450.00 price as of this writing and technically important support levels are being challenged. Ethereum, like most of the other major cryptocurrencies, suffered a weekend of strong selling, and intriguingly ETH/USD has provided quick prices velocity as it made its way lower breaking through key junctures. However spikes have not been violent, but the selling has been consistent.

ETH/USD has shown little ability to sustain a higher move the past week of trading and the inability of the cryptocurrency to maintain value is likely causing greater nervousness as crucial lower prices come into view. If ETH/USD falls below the 2400.00 mark near term, and is not able to climb above this level in a convincing manner, speculators may believe a test of Ethereum’s January 2022 low could be demonstrated. Behavioral sentiment is extremely fragile among traders, and if ETH/USD continues to trade within sight of late February values it could propel speculators to aim for this lower depths.

While the belief that ETH/USD has been oversold may be heard among many long term cryptocurrency backers, day traders are likely not interested in what the price of Ethereum could be six months from now. The bearish tone within the cryptocurrency market is echoing other global trading conditions as riskier assets have been sold. The question for value seekers is when the tide will turn and prices will move up.

However timing strong reversals remains difficult and day traders may want to simply continue following the trend. Price movement this weekend did prove fast and there will be more volatility in the days ahead, particularly if technically important support levels continue to be tested and break lower. ETH/USD should be monitored closely. If the 2425.00 level is brushed aside and momentum continues to incrementally nudge towards lower values, traders cannot be blamed for wanting to pursue selling positions.

Speculators need to use their risk management tactics wisely. ETH/USD and other major cryptocurrencies are testing junctures which will likely ignite abrupt price action as they are tested. Traders should choose their leverage cautiously. If ETH/USD falls below the 2400.00 mark, traders may want to continue chasing further declines. The bearish trend in Ethereum appears ready to create potentially cheaper values for the cryptocurrency.

Ethereum Short-Term Outlook

Current Resistance: 2497.00

Current Support: 2427.00

High Target: 2591.00

Low Target: 2316.00