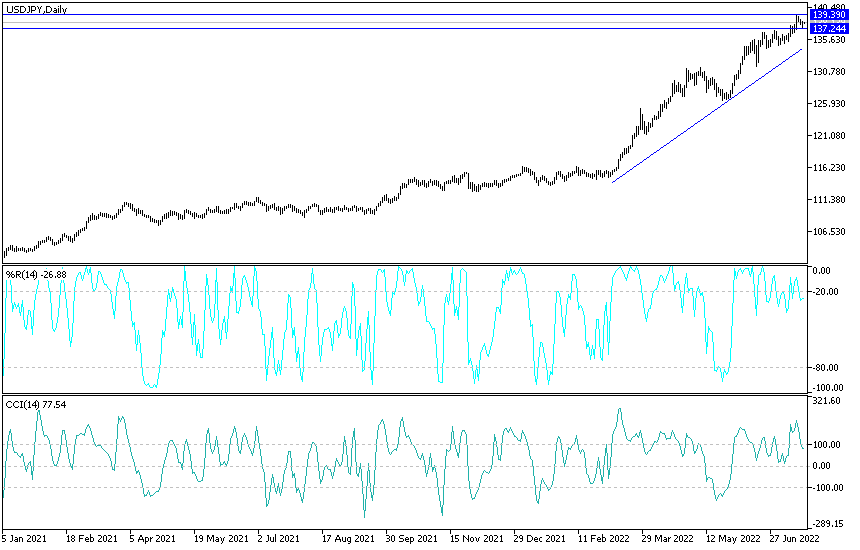

In the midst of profit-taking after the recent record gains, the USD/JPY currency pair is moving downwards, rebounding from its 24-year high of 139.38 resistance. The currency pair reached the support level at 137.38, and settled around the 138.00 level at the time of writing. The selling came after a temporary halt in the gains of the US dollar, following comments from some monetary policy officials that calmed a little of the market’s expectations that US interest rates will be raised throughout 2022.

The yen is a popular asset during turbulent times.

It may come as a surprise to see prices at home rising for the first time in decades, but a split appears to be forming between a growing number of bearish yen watchers in Tokyo and their more positive foreign counterparts. After dropping to a 24-year low, analysts are debating whether one of the hottest macro trades of the year – selling the yen – is overstated. Those in Japan suggest there is still plenty of time to wear shorts. Not so, according to analysts from Sydney to Geneva who say it’s almost time to trade as the Japanese yen slides further towards the psychological key level of 140 per dollar.

The trajectory of the Japanese yen is being closely watched by markets, with bets on further decline increasingly seen as the most pressing macro trade, according to a recent Bank of America survey of fund managers. Japan’s interest rate gap with the rest of the world, higher oil prices in the import-dependent country, and the emergence of the US currency have already pushed the currency down 17% for the year – the worst performance among the G10’s peers.

“Yen weakness is inevitable” as the Bank of Japan continues to pursue easy monetary policy, said Takuya Kanda, general manager at Gaitame.com Research Institute in Tokyo, which has a base value of 142 yen per dollar. However, there will be room for more dollar-yen upside if US interest rates rise, with a top of 147 likely.

In contrast, Tsuyoshi Ueno of the NLI Research Institute believes that there are no “obvious factors that make the yen stronger” as Bank of Japan Governor Haruhiko Kuroda declared that it was too early to abandon the easy policy. The continued weakness of the yen is the dollar hitting new highs as investors embrace the dollar smile argument – suggesting that the greenback can benefit in times of strong growth and during an economic slowdown.

“There are still opportunities to sell the yen,” added Ueno, who sees it testing 145 yen against the dollar. And “Japan will be the only country with negative interest rates, and the yen will be the main funding currency.”

It is a sentiment echoed by Tatsuhiro Iwashige at Fivestar Asset Management Co. For the Tokyo-based analyst, a “realistic target” for the yen would be 160 per dollar, a level last seen in 1990, could be the yen’s future reality. Iwashiji added that the currency’s decline was “justified by the difference in interest rates between Japan and the United States and the trade deficit.” “At the current level of 139 yen, there is still plenty of room to add to the short yen.” Analysts at National Australia Bank Ltd. Also worried about the extreme pessimism bombarding the third most traded currency in the world. Sydney-based Rodrigo Cattrell, who sees the currency likely to be as low as 130 by the end of the year, wrote in a note: “A breakout towards 145 cannot be ruled out, but the higher the rally the harder the fall.”

The yen will rise to end the year at 132 per dollar, according to a Bloomberg survey of analysts.

USD/JPY Forecast

Despite the recent sell-off, the USD/JPY currency pair still has a chance to maintain the bullish trend, and I believe that stability above the resistance 138.50 will open a move towards the psychological peak at 140.00. The last performance came naturally with profit-taking selling after its highest gains in 25 years. A first break of the general trend will not occur without stability below the 136.00 support level. The factors for the strength of the US dollar are strong and continuous.