[ad_1]

Gold prices rebounded, benefiting from the US dollar’s retreat from recent record highs and Treasury yields slightly lowered ahead of the Fed’s monetary policy announcement.

Solid stock markets and expectations of aggressive interest rate hikes limited gold’s rally. The gold price recovered from the support level of $ 1805 an ounce after sharp selling since the start of this important week’s trading. It then reached the level of $ 1842 an ounce, after the interest rate announcement from the US Federal Reserve. It settled around the level of $ 1835 an ounce, before the Bank of England and the Swiss Central Bank announced an update their monetary policy.

Stronger than expected, the US Federal Reserve moved to raise interest rates by 0.75 points, and expectations indicated a rise of only half a point. The US Federal Reserve has thus ramped up its campaign to tame high inflation by raising its key interest rate by three-quarters of a point, its biggest hike in nearly three decades and signaling more significant rate increases to come that would raise the risk of Another recession. The move, announced by the Fed after its last policy meeting, will raise the benchmark short-term interest rate, which affects many consumer and business loans, to a range of 1.5% to 1.75%. With the additional rate hikes they expect, policymakers expect the key rate to reach a range of 3.25% to 3.5% by the end of the year, the highest level since 2008, meaning most forms of borrowing will become sharply more expensive.

The US central bank is ramping up its campaign to tighten credit and slow growth as inflation hit a four-decade high of 8.6%, spread to more areas of the economy and showed no sign of slowing. Americans are also beginning to expect high inflation to continue for much longer than it used to be. This sentiment may embed inflationary psychology in the economy making it difficult to bring inflation back to the Fed’s 2% target.

The Fed’s three-quarter point rate increase exceeds the half-point increase that Governor Jerome Powell had previously suggested as likely to be announced this week. The Fed’s decision to force a significant rate hike yesterday was an acknowledgment that it is struggling to curb and sustain inflation, which has been exacerbated by Russia’s war against Ukraine and its impact on energy prices.

On the other hand, the European Central Bank has proposed creating a new tool to address retail risks across the single European currency bloc in order to alleviate fears of the debt crisis. The European Central Bank announced the move after an unscheduled monetary policy meeting in the wake of rising bond yields in the region.

The Bank of England, which is due to announce its policy on Thursday, is widely expected to announce another rate hike – the fifth in a row – to combat high inflation.

On the US economic front, a report from the Commerce Department showed that US retail sales fell 0.3% in May after rising by a downwardly revised 0.7% in April. Economists had expected retail sales to rise 0.2% compared to a 0.9% increase originally recorded from the previous month.

A separate report from the Labor Department showed that US import prices rose 0.6% in May after rising by a revised 0.4% in April. Economists had expected import prices to jump 1.1% from the original reading, which was unchanged from the previous month. Meanwhile, the report showed export prices rose 2.8% in May after a 0.8% increase in April. Export prices were expected to rise by 1.3%.

The New York Fed also released a report showing that regional manufacturing activity was little changed in June.

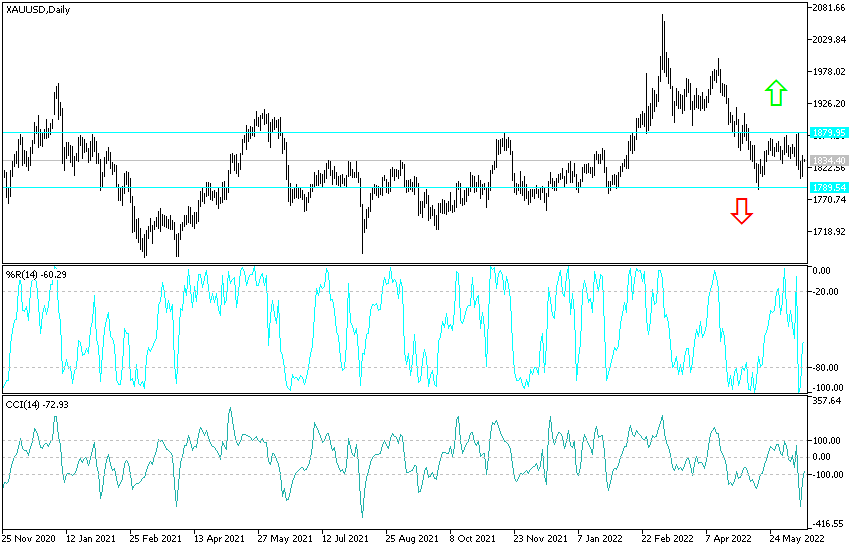

According to the technical analysis of gold: On the daily chart, the success of the bulls in pushing the price of gold to the vicinity of the resistance 1865 dollars for an ounce, the gold market will return to the neutral zone with an upward bias. Returning to our technical analyses regarding the future of the gold price, we have pointed out a lot on the importance of buying gold from every descending level. The move by global central banks to raise interest rates strongly is offset by other factors supporting gold, foremost of which are global geopolitical tensions and the suffering of the second largest economy in the world from a new outbreak of the pandemic.

Gold price’s move above the resistance of $1865 an ounce will give the bulls the impetus to move further up, and then the most important resistance levels will be 1877 and 1885 dollars, respectively. More risk appetite for investors and the recovery of the dollar may negatively affect the price of gold, but so far, I still prefer buying gold from every bearish level.

[ad_2]