[ad_1]

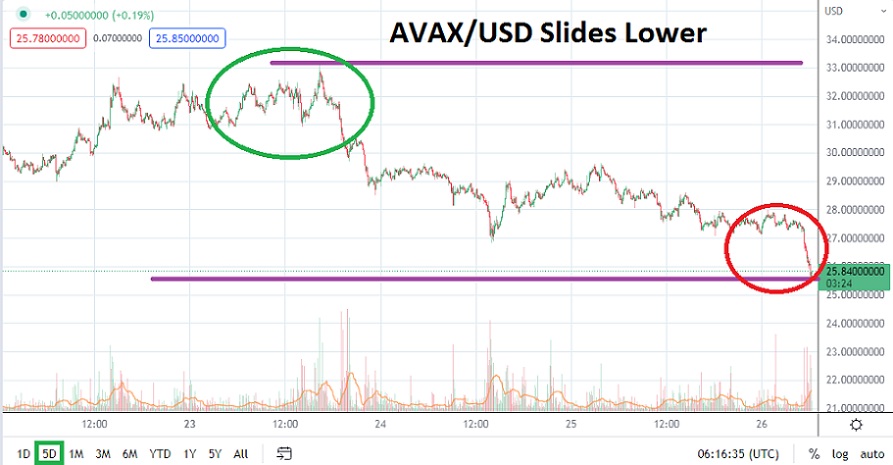

AVAX/USD has seen its value slide in early trading this morning, as the cryptocurrency fell through the key support and continued to stumble.

As of this writing, AVAX/USD is trading below the 26.00000000 value and its slide lower was intense after breaking 27.00 USD. Nervous trading in the broad cryptocurrency market is widespread. Avalanche has not been able to produce a legitimate reversal higher and the inability of AVAX/USD to fight its way off of support level may be troubling for speculators who are concerned about what will happen next.

Intriguingly AVAX/USD has not broken through early August 2021 values with a sustained penetration yet. The reason why this may be technically important is because many of the other major cryptocurrencies have pushed lower than their prices seen in August of 2021. AVAX/USD is still fighting these values, but this morning’s trading results shows that Avalanche may be fragile. If AVAX/USD falls below these August 2021 prices it could set off alarm bells among its backers.

If price velocity remains high in AVAX/USD and its values continue to challenge support levels, another stronger sell off may be demonstrated. Behavioral sentiment in the cryptocurrency market is nervous and speculative buyers appear in short supply still. If AVAX/USD doesn’t reverse higher and is not able to maintain a price above the 26.00000000 this could be viewed as a negative signal.

On the 23rd of May, AVAX/USD was able to trade near the 33.00000000 juncture, but since then Avalanche incremental selling has continued to break through support levels. Yesterday’s trading took AVAX/USD lower and when the 27.00000000 mark began to be flirted with choppy trading ensued. When this value was broken lower this morning, the price of Avalanche did see increased trading volume.

The low seen early today was around the 25.65000000 level, and if this level should come into sight again and actually falter, another round of violent selling could ensue. AVAX/USD is trading within rather weak territory. If a contrarian bullish trader believes Avalanche has been oversold and is looking for slight speculative moves higher, they should use strict stop losses in case the market goes against their wagers.

Speculators who remain skeptical about the current value of AVAX/USD in the short term may want to remain sellers. Conservative traders should use existing nearby support levels as their ignition points to look for reversals lower. Trading in AVAX/USD has been volatile this morning and this may continue throughout the day.

Avalanche Short-Term Outlook

Current Resistance: 26.75000000

Current Support: 25.25000000

High Target: 28.96000000

Low Target: 18.68000000

[ad_2]