[ad_1]

The USD/MXN is near important support levels as the U.S central bank awaits, but considerations regarding the price of WTI Crude Oil may be the critical factor.

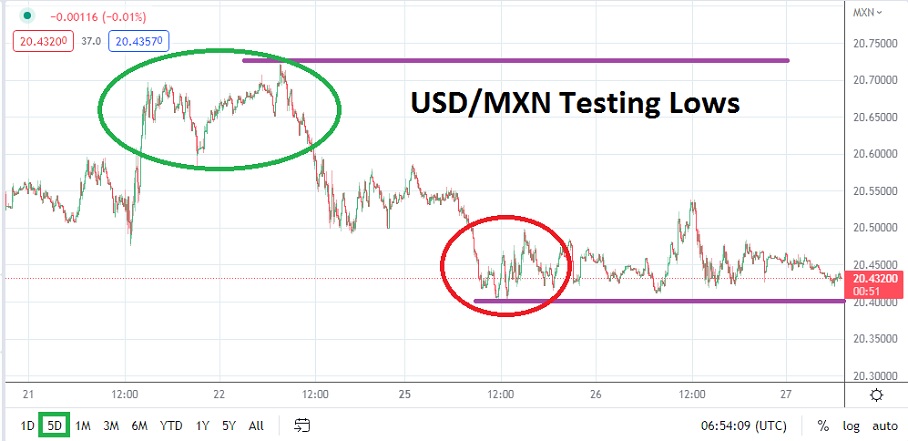

The USD/MXN is near the 20.42000 mark, as of this writing as the Forex pair straddles short term support levels within a rather tight range. Volatility does exists within the USD/MXN and traders should not be lulled to sleep by the consolidation, yesterday the currency pair did hit a high of nearly 20.55000, and the day before saw a value of nearly 20.59600.

On the 14th of July the USD/MXN did climb to an apex of 21.05500, intriguing the price of WTI Crude Oil on that date was trading near the 88.50 per barrel – a low not seen since the third week of February 2021. While the U.S Federal Reserve will impact Forex and the USD/MXN with its interest rate hike and outlook this evening, speculators who like technical comparison may want to compare charts of the USD/MXN to WTI Crude Oil.

Latin American currencies can give great price movements.

Trade them with our featured broker.

Trade Now !

If Crude Oil Prices remain Strong the USD/MXN will remain Intriguing and perhaps Bearish

The U.S central bank interest rate hike has certainly been digested into the marketplace for the USD/MXN. A hike of 0.75% is expected and if this is the outcome, traders will turn their attention to Federal Reserve outlook. The U.S interest rate is important for the USD and all other major currencies including the Mexican peso, but the price of Crude Oil cannot be overstated regarding the value for the USD/MXN. Simply put Mexico is a huge producer of energy, and this fact has kept the Mexican peso relatively strong compared to many of its major counterparts versus the USD.

- WTI Crude Oil is trading near 95.00 USD per barrel currently, and the USD/MXN is testing important short term support levels.

- If the price of Crude Oil remains near its current values, it will help the Mexican peso sustain value within the USD/MXN even with an additional rate increase today via the U.S central bank.

The USD/MXN may continue to exhibit Bearish Tendencies Moving Forward

If current support levels continue to act like a magnet, the USD/MXN could start to challenge lower values later today. The U.S Fed’s interest rate hike has largely been dealt with by financial houses, if there are no surprises the USD/MXN may actually start to challenge and penetrate current support levels today. If the 20.40000 support ratio is broken, it is not unreasonable to suspect the USD/MXN currency pair could test the 20.36000 to 20.33000 rather quickly.

Some volatility is a certainty today as U.S interest rate policy is announced. Tomorrow U.S economic data regarding growth is in the cards too, but traders of the USD/MXN should monitor the correlation of Crude Oil to the currency pair. If energy prices remain stable to strong, the USD/MXN is likely to continue to show selling tendencies. Upwards moves by the USD/MXN may present selling opportunities for speculators who are willing to wager on downside movement being demonstrated.

USD/MXN Short-Term Outlook

Current Resistance: 20.50500

Current Support: 20.40800

High Target: 20.82890

Low Target: 20.23300

Ready to trade our Forex daily analysis and predictions? Here are the best Forex brokers to choose from.

[ad_2]