[ad_1]

At this point, I do not have any interest in buying the US dollar against the Brazilian real, although I am very interested in buying the US dollar against multiple other currencies.

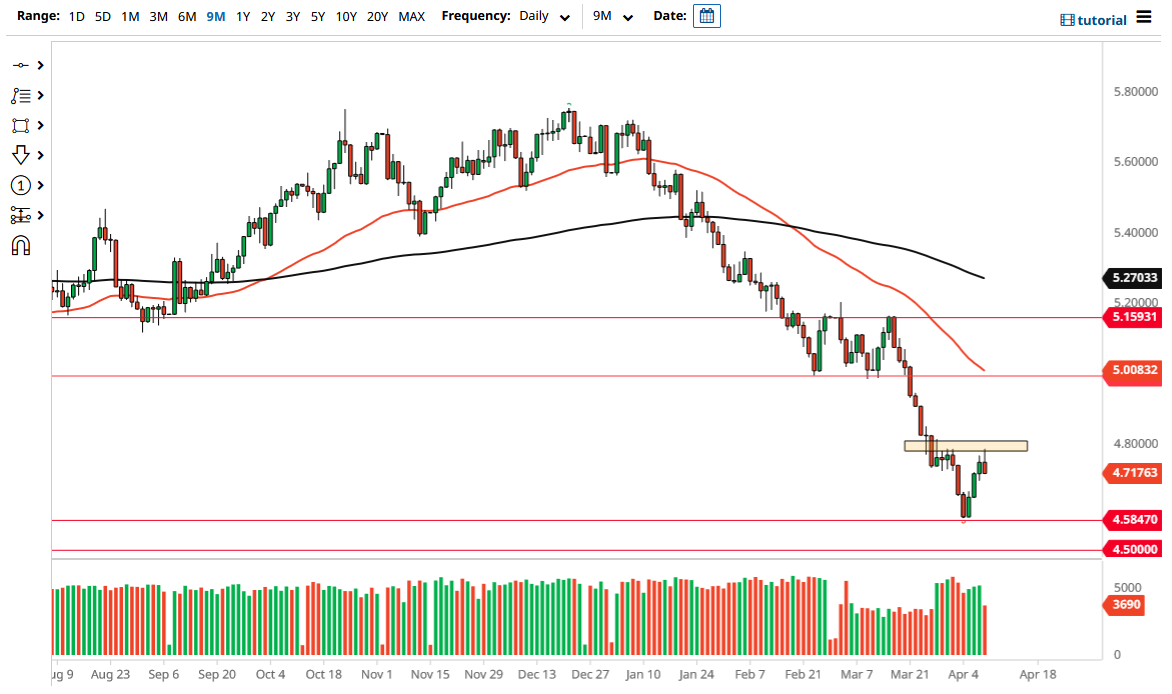

The US dollar initially rallied against the Brazilian real on Friday, testing the 4.80 BRL level. This is an area that previously has been resistance, so it does make a certain amount of sense that it would act as resistance again.

Latin American currencies can give great price movements.

Trade them with our featured broker.

Trade Now !

The candlestick has formed a shooting star, and if we break down below the bottom of the candlestick, then it should be a nice continuation of the overall downtrend that we have seen. After all, interest rate differentials continue to favor Brazil, not to mention the fact that Brazil is a major exporter of soft commodities, something that has performed quite well over the longer term. After all, as inflation rises, certain commodities will continue to strengthen.

When you look at this chart, pay attention to the fact that the 4.58 level has caused a bit of a bounce. Now that we are trying to roll over again, that might be the short-term target. Underneath there, then we have the psychologically important 4.50 BRL level, something that I think would cause a little bit of a psychological bounce. Alternately, if we can break above the 4.80 BRL level, we could get a bit of a recovery. In fact, we could rally all the way back to the 5.00 BRL level within reason. The 50-day EMA is sitting just above there and is grinding lower, so it could happen to be a major resistance barrier as well.

This is a market that has been in a downtrend for quite some time, so every time it rallies you have to look at it as a potential opportunity to pick up the Brazilian real “on the cheap.” While the US dollar has been very strong against most other currencies, the Brazilian real has the benefit of being an agricultural exporter with higher interest rates. Furthermore, the Brazilian real has been shellacked until recently, due to the fact that they had a massive amount of coronavirus infections. As that goes away, and fears of the pandemic dissipate, that also helps some of these emerging market currencies that had been such punching bags during that issue. At this point, I do not have any interest in buying the US dollar against the Brazilian real, although I am very interested in buying the US dollar against multiple other currencies.

[ad_2]