[ad_1]

Japan’s determination to maintain the stimulus policy and ignore the path of the rest of the global central banks in tightening and raising interest rates contributed to a new collapse of the Japanese yen in the forex market. Since the start of trading this week, the price of the currency pair, the US dollar against the Japanese yen, recorded sharp bullish breaches. Its impact is towards the resistance level is 133.00, which is the highest in 20 years.

Japanese Prime Minister Fumio Kishida is likely to want the Bank of Japan to stick to its current policy direction even after a conservative change, according to a senior member of the ruling party. In this regard, Shoji Nishida, head of a pro-spending group in the party with ties to former Prime Minister Shinzo Abe, cited the fiscal policy plan published last week as evidence that Kishida is more committed than previously thought to the BoJ’s inflation target. A draft policy released by the Finance Ministry emphasized a 2% inflation target, as the BoJ had pursued under Governor Haruhiko Kuroda. But this time it added the words “sustainably and consistently” in reference to how to achieve the target set by the Abe government in 2013.

“What that means is that the policy cooperation with the Bank of Japan that was created under Abenomics must continue,” Nishida added in an interview last week. “This means that the next BOJ Governor must stay on Kuroda’s path.” Nishida’s comments come amid strong interest in who will succeed Kuroda when he steps down next spring. Economists and investors want to know if Kishida will look to reposition the Bank of Japan away from the ultra-low interest rate stance that helped push the yen to its lowest levels in two decades as other global central banks raised interest rates to curb inflation.

The wording change also suggests that the Nishida group may be gaining traction as a voice within the LDP. Kishida’s new capitalist plans and his talk of increasing the defense budget indicate that the government may initiate more spending. To finance various projects, Japan will need more debt issuance, and it will benefit from keeping interest rates low.

The loose wording in the financial draft on the government’s budget balance indicates that spending can be increased even after an additional budget was approved last week. While the government has said it will continue to meet its current goal of pursuing fiscal soundness, it has removed direct reference to balancing the state’s books by the end of fiscal year 2025. Nishida added that dropping the calendar-based target is a clear sign of change. “Politics in Japan is now moving towards a more aggressive fiscal policy.”

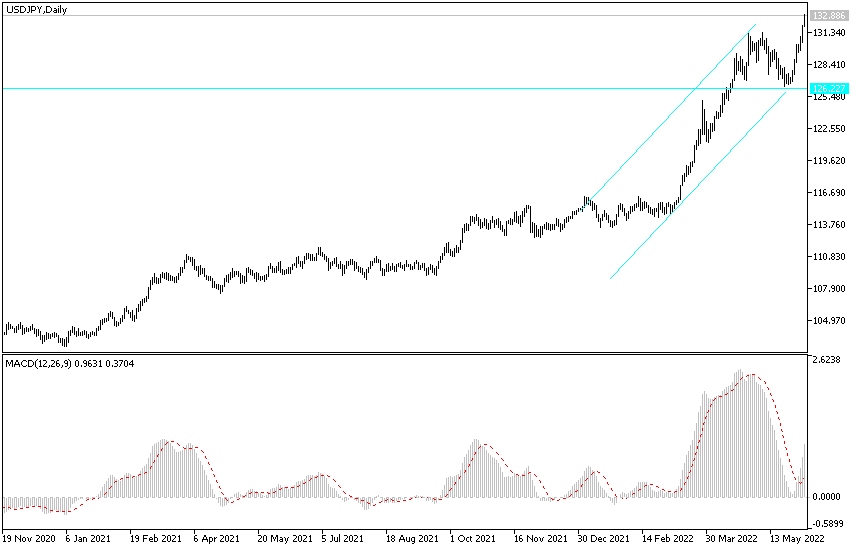

According to the technical analysis of the pair: Undoubtedly, the gains of the USD/JPY currency pair moved the technical indicators towards overbought levels, but the continuation of its gains factors may make the currency pair maintain its rebound gains for a longer period. In general, as long as the dollar-yen pair is above the psychological resistance 130.00, the general trend of the currency pair will remain bullish, and the closest resistance levels for the current trend are 133.20 and 134.00, respectively. The currency pair may maintain its track until the release of US inflation figures by the end of the week.

To turn to the downside, the dollar-yen pair will have to settle below the 130.00 level as a first stage.

[ad_2]