[ad_1]

Fed policy and the financial conditions affecting it have shifted in a tighter direction at a brisk pace since June of last year, but several influential members of the Federal Open Market Committee (FOMC) recently suggested that markets may have to move. Amidst the path of a strong tightening of the US interest policy, the price of the USD/JPY currency pair moved in a strong upward path. The bulls in the currency pair jumped to the resistance 130.89 at the beginning of this week’s strongest trading for the currency pair in 20 years.

Overall, financial markets are already expecting the Fed to raise the US interest rate by 0.50% after the FOMC meetings in June and July, which would raise the Fed funds rate close to 2%, the highest level since 2019. In addition to However, the rates or prices in the overnight index swap market were suggesting expectations among investors and traders that the bank could raise the benchmark index further up to 2.75% by the end of the year.

Notes from several FOMC members recently published suggested that even those expectations could be too low if the Fed were to succeed in its efforts to bring inflation down to the bank’s average target of 2%, from 8.5% in April. “In my view, with inflation rising as it is, it is likely that the money rate will need to surpass its long-term neutral level to rein in inflation,” said Loretta Meester, president of the Federal Reserve Bank of Cleveland. But we can’t make that call today because it will depend on how much demand is moderate and what happens on the supply side of the economy and “therefore, we need to continue to closely monitor economic and financial developments.”

Meester has described these US inflation rates as reflecting an imbalance between “strong aggregate demand” resulting from the economy emerging from the hibernation caused by the coronavirus and “constrained aggregate supply” resulting from a variety of factors including the implementation of a start-up of restrictions elsewhere in the world.

She added: “Some of our business contacts described the situation as akin to Whac-A-Mole. Once they figure out how to solve a problem in one part of their supply chain, a problem arises in another.” “This means that the supply chain disruptions have lasted much longer than the companies expected,” she added.

Elsewhere in the Fed’s speech, Vice Chairman Lyle Brainard noted that the current market pricing of US interest rates is the least to expect, while fellow Board member Christopher Waller has been as hawkish as St. Louis Fed President James Pollard. “We will certainly do what is necessary to bring down inflation again,” he said. We start from a position of strength. The economy has a lot of momentum. The other factor that I think is very positive, he added, is that corporate balance sheets, family budgets, start this process from a very healthy position.

“On inflation, I’ll look forward to seeing a consistent series of decelerating monthly prints of core inflation before I feel more confident that we’re hitting the kind of inflation trajectory that will bring us back to the two percent target,” she said in an interview with CNBC News. In terms of our tools, they are very effective in cooling aggregate demand.”

Previously, St. Louis Fed President James Bullard said US inflation was comparable to levels seen in the 1970s and warned that US inflation expectations could become unconstrained without credible Fed action. James Bullard’s worry is that without that the Fed may risk inviting a new regime of high inflation and volatile economic outcomes. “This situation threatens the Fed’s credibility with regard to the inflation target and its associated mandate to provide stable rates in the United States,” he added. “Advance guidance on these dimensions helps the Fed move policy more quickly to the degree necessary to keep inflation in check,” he added.

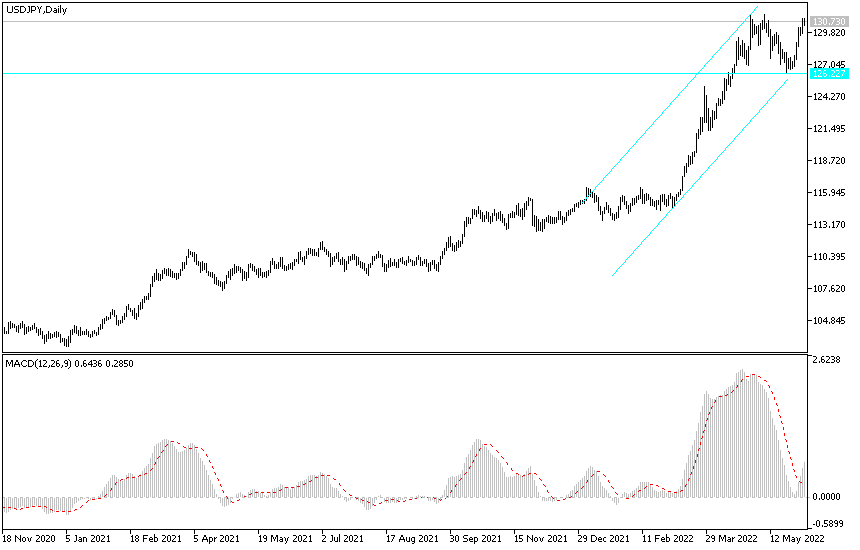

According to the technical analysis of the pair: The above narrative confirms our view that the USD/JPY currency pair will remain in an upward trend. Any retracement of the currency pair will be an opportunity to buy, as Japan is still suffering from the consequences of the pandemic. The continuation of the Russian-Ukrainian war and the Central Bank of Japan is completely far away in the issue of tightening his policy as do the rest of the global central banks led by the Federal Reserve. Stability above the psychological resistance 130.00 will continue to support the bulls in further movement to the upside. The closest goals to them are currently 131.20 and 132.00, respectively.

On the daily chart below, the dollar-yen pair is moving steadily within its ascending channel, and no new occurrence for that channel will occur without moving below the support 128.30.

[ad_2]