[ad_1]

With the beginning of this week’s trading, the price of the US dollar against the Japanese yen returned to stability above the 130.00 psychological resistance, its highest in 20 years. It gains to the level of 130.22 at the time of writing the analysis, as the US dollar is still stronger than expectations of raising US interest rates. This week we will be watching these expectations. As the US Federal Reserve prepares this week to accelerate its most drastic step in three decades to attack inflation by making borrowing more expensive — to buy a car, a house, a business deal, or a credit card — all of which will double Americans’ financial position. There is pressure and will potentially weaken the US economy.

However, with inflation at a 40-year high, the Fed has come under extraordinary pressure to act aggressively to slow spending and curb price hikes that are overwhelming households and businesses.

After its last rate-setting meeting ends on Wednesday, the Fed will almost certainly announce that it is raising its benchmark short-term interest rate by half a percentage point — the largest rate increase since 2000. The Fed is likely to implement another half-point hike interest rate at its next meeting in June and possibly at the next meeting after that, in July. Economists expect prices to continue to rise in the following months.

Moreover, the Fed is also expected to announce tomorrow, Wednesday, that it will quickly begin to reduce its massive stock of Treasury and mortgage bonds starting in June – a move that will have the effect of further credit tightening. Fed Governor Jerome Powell and the Federal Reserve will take these steps largely in secret. No one knows how far the central bank’s short-term interest rate must go to slow the economy and curb inflation. Nor do officials know how far they can reduce the Federal Reserve’s unprecedented $9 trillion balance sheet before they risk destabilizing financial markets.

However, many economists believe that the Fed is already acting too late. Even with inflation rising, the Fed rate is in a range of just 0.25% to 0.5%, a level low enough to spur growth. Adjusted for inflation, the Fed’s key interest rate – which affects many consumer and business loans – is deep in negative territory.

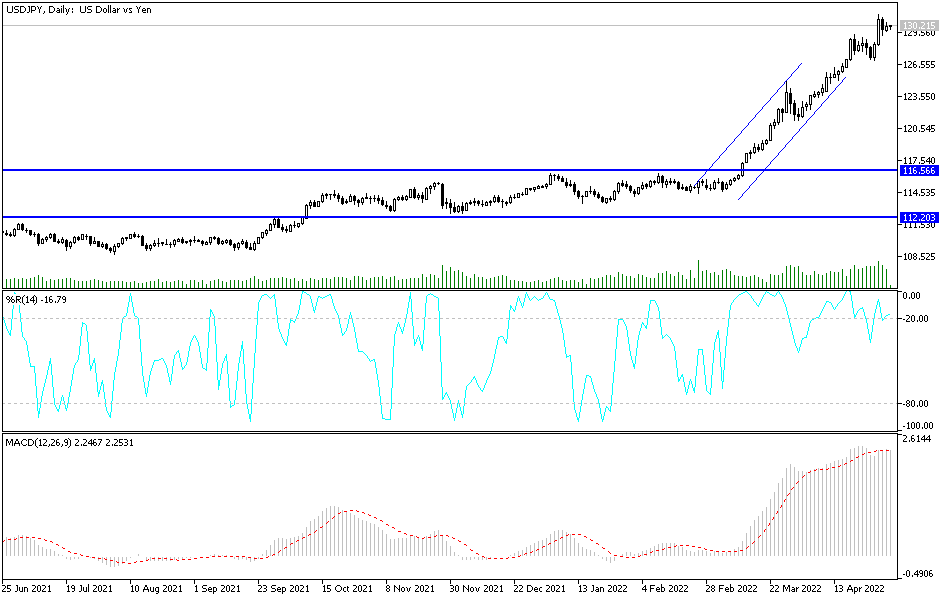

According to the technical analysis of the pair: There is no doubt that the return of the stability of the USD/JPY currency pair around and above the 130.00 psychological resistance will continue to support the strength of the upward trend. It will also warn of a stronger bullish move, and the closest to it are currently the resistance levels 130.85, 131.20 and 132.00, respectively. Forex investors still ignore the arrival of technical indicators towards overbought levels and focus more on the continuation of the factors of the US dollar’s strength, led by the future of raising US interest rates and the clear contrast between the policy of the Federal Reserve and the Japanese Central.

On the downside, and according to the performance on the daily chart, the currency pair needs to break the support 126.90 to change the current trend to the downside.

[ad_2]