[ad_1]

The most important events in the Forex market last week were in favor of the continued strength of the US dollar in the market, and the currency pair USD/JPY launched towards the resistance level 136.56, near its highest in 24 years, and settled around the level of 136.00 at the beginning of this week’s trading. The minutes of the last meeting of the US Federal Reserve and US job numbers are still in favor of the path of aggressive US interest rate hikes throughout 2022 to contain record US inflation.

The yen is a popular asset during turbulent times.

Overall, any further upward revision by the market of US interest rate expectations will do nothing but amplify analysts and economists’ recent concerns about recession risks in the US and the global economy, a risk many recently described as rising.

According to economic analysis, the USD/JPY currency pair is being traded affected by important and unexpected events. Japan was hit by a major tragedy on Friday following the assassination of former Japanese Prime Minister Shinzo Abe. The geopolitical turmoil did not help the Japanese yen, which continued to slide against the dollar. Besides, the Eco Watchers survey for June beat the current forecast of 52.4 with a reading of 52.9, but missed the forecast of 51.6 with a reading of 47.6.

From the US, the US non-farm payrolls performance for June exceeded expectations at 268 thousand jobs with 372 thousand jobs recorded, while the US unemployment rate was in line with estimates at 3.6%. On the other hand, average hourly wage growth improved by 5.2% (y/y), beating the estimate of 5% while also matching the (mo) forecast of 0.3%. Earlier in the week, US initial jobless claims and continuing claims missed estimates. The ISM Services PMI exceeded expectations of 54.5 with a reading of 55.3, while the vertical sectors associated with it came in below expectations.

USD/JPY Forecast

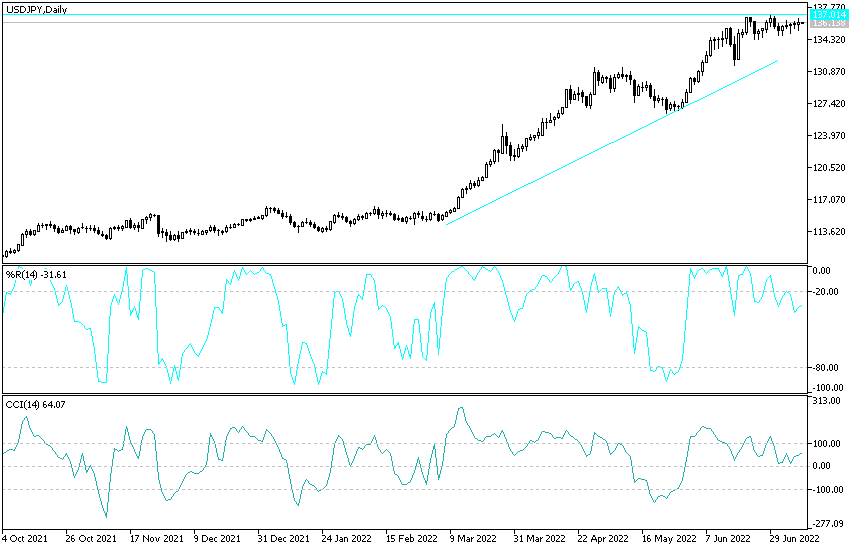

In the near term and according to the performance on the hourly chart, it appears that the USD/JPY is trading within an ascending channel formation. This indicates a significant short-term bullish momentum in market sentiment. Therefore, the bulls will target short-term profits at around 136,474 or higher at the resistance of 136,978. On the other hand, the bears will target the possibility of a pullback at around 135,625 or lower at 135.153.

In the long term and according to the performance on the daily chart, it appears that the USD/JPY is also trading within an ascending channel formation. This indicates a significant long-term bullish momentum in market sentiment. Therefore, the bulls will look to extend gains by targeting profits at around 138,088 or above at the resistance of 140.349. On the other hand, the bears can target long-term profits at around 134,268 or lower at the 132.085 support.

[ad_2]