[ad_1]

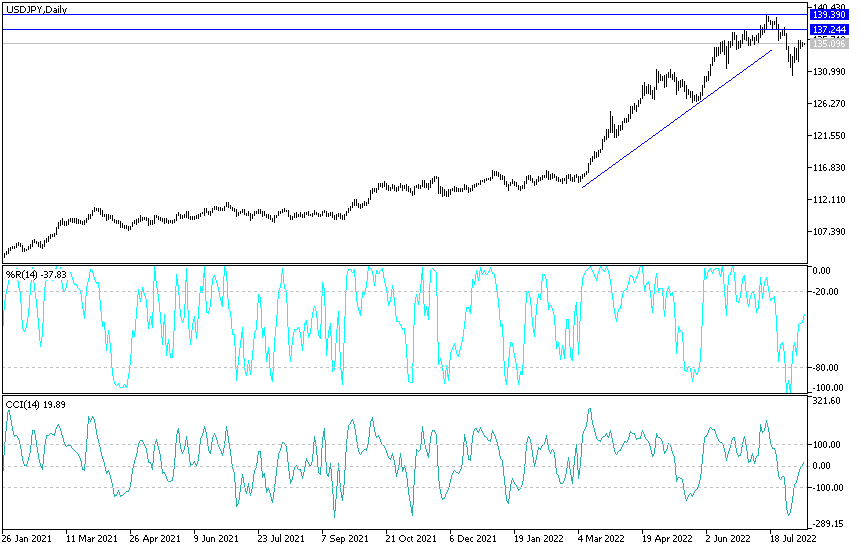

For four trading sessions in a row, the bulls failed to push the USD/JPY currency pair to more than the 135.58 resistance level. The US dollar pairs await the announcement of US inflation figures, which have a strong reaction to the future expectations of raising US interest rates in the remainder of the year 2022. The dollar-yen pair is stabilizing around the 135.10 level at the time of writing the analysis.

The US Labor Department will release its July consumer price report on Wednesday, followed by its producer price report on Thursday. Investors and economists will be looking for any signs that sharp US interest rate increases by the Federal Reserve in the past few months have helped to control inflation.

For its part, the Federal Reserve has raised US interest rates four times this year in an attempt to rein in the economy and cool the hottest inflation in four decades. Wall Street markets are concerned that the central bank could slam the brakes too hard and push the economy into recession. Last week’s strong US jobs report had most economists expect the Federal Reserve to raise short-term interest rates again by another three-quarters of a point at its September meeting.

USD/JPY Economic Outlook

Most economic data is already pointing to a slowdown. The US economy has now contracted for two consecutive quarters, which is an unofficial indicator of recession. But recession fears were eased by a hot jobs market as US unemployment fell to its historic lows. While this is good for the economy, it is a sign of persistent inflation.

What else is currently affecting the markets?

The fighting in Ukraine and the attacks on Europe’s largest nuclear plant are other factors hanging over the markets. Moscow and Kiev have accused each other of bombing a nuclear power plant in the Russian-occupied southeast of Ukraine, attacks that have raised international concern. The Zaporizhzhia Nuclear Power Plant has six nuclear reactors, and the fighting around them has increased the risk of a nuclear accident.

Forecast of the US dollar against the yen:

- The performance of the USD/JPY currency pair may remain stable around its recent gains until the US inflation figures are announced.

- This completes the picture for the US economy and the path of raising US interest rates.

- Currently, the nearest resistance levels for the dollar pair are 135.85, 136.20 and 137.00, respectively.

- A break of the support level 132.25 will be important for the bears to dominate.

- The general trend of the dollar-yen is still bullish.

Ready to trade our daily Forex analysis? We’ve made a list of the best Forex brokers worth trading with.

[ad_2]