[ad_1]

For three trading sessions in a row, the bulls are settling in the price of the USD/JPY currency pair around the resistance level at 125.75, the highest in six years. Despite the announcement of strong US inflation numbers that support the policy of the US Federal Reserve, the price of the currency pair remained stable in its last range. This may give an image to the markets that the currency pair has reached its recent gains on technical indicators towards overbought levels. Overall, there was a noticeable reaction in the forex foreign exchange market to the release of US inflation data which showed prices rose sharply in March, keeping expectations alive for a series of large US interest rate increases. However, the market reaction indicates that the inflation data was not quite as hot as expected and the dollar was sold off as a result.

Core inflation in the US rose 0.3% on a monthly basis in March, down from the 0.5% recorded in February which is disappointing versus the 0.5% that the market was looking for. The annual core CPI grew 6.5%, up from 6.4% in February, but less than the 6.6% market forecast.

Core CPI inflation grew 8.5% in March, beating expectations of 8.4% and the previous month’s 7.9%. The reaction of the forex market indicates that investors have certainly focused more on the core inflation component, given that the headline figure is heavily influenced by global energy prices.

The Federal Reserve is expected to respond to rising inflation by raising US interest rates by up to 220 basis points in 2022, with two consecutive increases of 50 basis points expected in the next two meetings alone. If inflation begins to slow faster than expected, those expectations may be mild.

As a result, the dollar’s rally may also be moderate.

“Unless the oil price rises sharply again, this could be the peak,” says Christoph Bales, an economist at Commerzbank. “Even in this case, however, inflation is not expected to fall quickly. So the Fed remains under pressure.”

Key inflation data shows that the majority of price pressures facing Americans are rooted in global factors related to rising oil and commodity prices. Used car prices have fallen by 3.8%, as one of the main drivers of inflation in 2021 is now beginning to provide a physical drag. Prices of goods outside of energy and food fell 0.4%. Analysts are of the view that whether the inflation rate has peaked in March depends above all on the further development of oil and gasoline prices. If the oil price remains at the current level of around $100 per barrel of Brent and does not rise again, then March will probably be the highest in the inflation rate.

If inflation begins to decline, expect the US Federal Reserve’s hike expectations to come in handy. From a currency market perspective, this could mean that the dollar is approaching its peak.

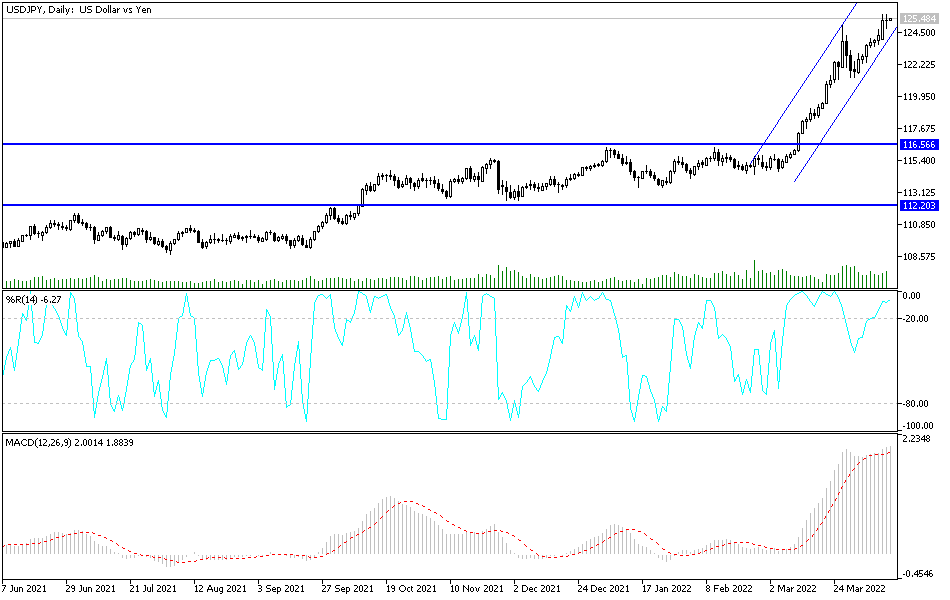

According to the technical analysis of the pair: I still warn that the recent gains of the US dollar against the Japanese yen pushed the technical indicators towards overbought levels. With the impetus for raising US interest rates to stop, the currency pair may be exposed to strong profit-taking operations. The closest goals for the bulls are currently 125.75, 126.20 and 127.00, respectively. On the other hand, according to the performance on the daily chart, a trend reversal will not occur without breaching the 120.00 support – the psychological top previously – and so far, the divergence in economic performance and the future of tightening global central bank’s policy will remain in favor of the strength of the upward trend.

[ad_2]