[ad_1]

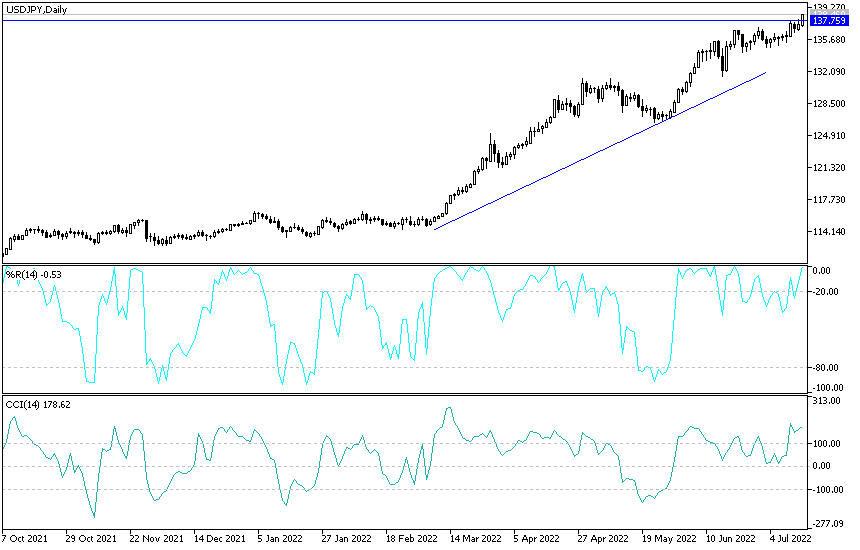

There is no doubt that the stronger US inflation figures increased the markets’ bets that the US Federal Reserve would be more aggressive in the coming months in the pace of raising US interest rates. Therefore, it was natural for the USD/JPY currency pair to complete the upward path and reach the resistance level 138.65, and the currency pair is settling around these gains, waiting for any new.

The yen is a popular asset during turbulent times.

On the other hand, we find the Bank of Japan focusing on a very loose monetary policy, as both the Central Bank and the Government of Japan openly support a weak Japanese yen. While there was some speculation that the Bank of Japan would have to intervene (to strengthen the currency) or adjust the yield curve control, such action did not rise while comments from Japanese central authorities favored a weaker currency.

The US dollar has room to extend its gains and stocks are likely to continue falling after the latest US inflation data. Other expectations include a further inversion of the US yield curve, renewed weakness in the yen and finally pushed the euro below parity with the dollar.

Ahead of the release of US inflation figures, which recorded their highest in 40 years, Ben Powell, an investment analyst at the BlackRock Institute for Investment in Asia and the Pacific, said in an interview with Bloomberg TV that markets are going through a paradigm shift from a somewhat loose policy era with low inflation and low rates. , to an inherently more volatile world shaped by supply. So “we think investors of all kinds now should be a little smarter, and I think focus a little bit more on selectivity, rather than just a buy any pullback mentality. And basically, central banks are not there for us the way they have been for most of the past several decades.”

Pepperstone Group Head of Research Chris Weston stated, “The CPI reading below 8.5% will spur the bulls, with bond yields very low, so I imagine (in this scenario) the dollar drops globally, crypto goes up 5 percent. %+, Nasdaq 100 + 2.5% to 3%, Gold +1.5% Conversely, a number above 9% can validate the US dollar’s long position in the market and reinforce the idea that inflation will be high for the rest of the calendar year.” .

USD/JPY Forecast

There is no doubt that the USD/JPY price move above the resistance 138.50 strongly supports the upcoming stronger bullish move, the 140.00 psychological summit, its highest in 24 years. Unless there is a Japanese intervention in the markets to stop the collapse of the Japanese yen, the currency pair is a candidate for what is further than that, as the factors of the strength of the US dollar are strong and continuous. Accordingly, any decline in the USD/JPY is normal after the successive record gains, as all technical indicators have reached overbought levels, and any decline will be a new opportunity to buy back the USD/JPY.

The closest support levels for the dollar are 138.00, 137.25 and 136.55, respectively. Today, the US dollar will await the announcement of the producer price index reading and the number of US weekly jobless claims.

Ready to trade our daily Forex analysis? We’ve made a list of the best brokers to trade Forex worth using.

[ad_2]